|

Audit, Risk and Finance Committee Kōmiti Arotake Tūraru me Ahumoni

ARF25-2 Wednesday, 4 June 2025, 9.30am Council Chambers, 1484 Cameron Road, Tauranga

|

|

Audit, Risk and Finance Committee Kōmiti Arotake Tūraru me Ahumoni

ARF25-2 Wednesday, 4 June 2025, 9.30am Council Chambers, 1484 Cameron Road, Tauranga

|

|

4 June 2025 |

Audit, Risk and Finance Committee

Membership:

|

Chairperson |

Cr Murray Grainger |

|

Deputy Chairperson |

Cr Tracey Coxhead |

|

Members |

Cr Grant Dally Mayor James Denyer Cr Anne Henry Cr Rodney Joyce Cr Margaret Murray-Benge Cr Laura Rae Deputy Mayor John Scrimgeour Cr Allan Sole Cr Don Thwaites Cr Andy Wichers Stuart Henderson – Independent Member |

|

Quorum |

Seven (7) |

|

Frequency |

Quarterly |

Role:

The main purpose of the Committee is to assist Council in providing oversight of matters relating to the quality and integrity of financial reporting, independence and performance of the external auditors, effectiveness and objectivity of the internal audit programme, and oversight of business risks and compliance activities.

Scope:

Responsibilities:

· Assist Council in fulfilling its responsibilities for financial statements and external financial reporting.

· Monitor the Council’s external and internal audit process and the resolution of any issues that are raised.

· Review key formal external accountability documents such as the Annual Report in order to provide advice and recommendation in respect to the integrity and appropriateness of the documents and the disclosures made.

· Provide a forum for communication between management, internal and external auditors and the governance level of Council.

· Ensure the independence and effectiveness of Council’s internal audit processes, with oversight of the internal audit programme and findings.

· Oversee the development of the Council’s Annual Report.

· Oversee the development and management of financial policies and delegations.

· Monitor existing corporate policies and recommend new corporate policies to prohibit unethical, questionable or illegal activities.

· Support measures to improve management performance and internal controls.

Responsibilities:

Audit (internal and external):

· Ensure appropriate accounting policies and internal controls are established and maintained and

· assist Council in ensuring the effective and efficient management of all business risks.

· Ensure an appropriate framework is maintained for the management of strategic and operational risk (including risk appetite). Review risk including technical insurance matters

· and participation in national risk management practices, health and safety risk management and implementation of risk management processes.

· Review the effectiveness of the Long Term Plan audit or any audit relating to an amendment to the Long Term Plan

· Review the effectiveness of the annual audit.

· Monitor management response to audit reports and the extent to which the external audit recommendations concerning internal accounting controls and other matters are implemented.

· Monitor the delivery of any internal audit work programme and implementation of any significant recommendations including control risk, accounting and disclosure practices.

· Engage with Councils external auditors regarding the external work programme and agree the terms and arrangements of the external audit in relation to the Annual Report.

· Engage with internal and external auditors on any specific one-off audit assignments.

· Review the effectiveness of the control environment established by management including the computer information management systems controls and security. This also includes a review/monitoring role for relevant policies, processes, and procedures.

Risk management:

· Review the Risk Management Framework, and associated procedures to ensure they are current, comprehensive and appropriate for the effective identification and management of Council’s financial and business risks including fraud and cyber security.

· Review the effectiveness of the system for monitoring Council’s financial compliance with relevant laws, regulations and associated government policies.

· Review whether a sound and effective approach has been followed in establishing Council’s business continuity planning arrangements.

· Review Council’s Fraud Policy to determine that Council has appropriate processes and systems in place to capture and effectively investigate fraud related information.

Financial:

· To monitor the operational performance of Council’s activities and services against approved levels of service.

· Monitor financial performance against any Council approved joint contracts with other local authorities.

· Report financial outcomes and recommend any changes or variations to allocated budgets including both operational and capital expenditure.

· Provide oversight of legal risks, claims or proceedings (excluding the approval of any legal settlements).

· Recommend the adoption of the Annual Report and the approval of the Summary Annual Report to Council.

Power to Act:

The Committee is delegated the authority to:

· Receive and consider external and internal audit reports.

· Receive and consider staff reports on audit, internal control and risk management policy and procedure matters as appropriate.

· To approve the Auditors engagement and arrangement letters in relationship to the Annual Report.

Power to Recommend:

To make recommendations to Council and/or any Committee as it deems appropriate.

Power to sub-delegate:

The Committee may delegate any of its functions, duties or powers to a subcommittee, working group or any other subordinate decision-making body, subject to the restrictions on its delegations and provided any sub-delegation includes a statement of purpose and a specification of task.

|

Audit, Risk and Finance Committee Meeting Agenda |

4 June 2025 |

Notice is hereby given that an Audit, Risk and Finance Committee Meeting will be held in the Council Chambers, 1484 Cameron Road, Tauranga on: Wednesday, 4 June 2025 at 9.30am

10.1 People and Wellbeing Report

10.2 Audit Management Report 2023/24

10.3 Outstanding Recommendations Register - May 2025

10.4 Financial Performance Update - 30 April 2025

10.5 Review of Accounting Policies and Key Accounting Judgements - Annual Report 2024/25

10.6 Proposed sale of Zespri and Seeka shares

11.1 Local Government Official Information Request - Quarter 4 Report (2024/25)

12 Resolution to Exclude the Public

12.1 Litigation Register Update - May 2025

|

Whakatau mai te wairua Whakawātea mai te hinengaro Whakarite mai te tinana Kia ea ai ngā mahi

Āe |

Settle the spirit Clear the mind Prepare the body To achieve what needs to be achieved. Yes |

2 Present

Members are reminded of the need to be vigilant and to stand aside from decision making when a conflict arises between their role as an elected representative and any private or other external interest that they may have.

A period of up to 30 minutes is set aside for a public forum. Members of the public may attend to address the Board for up to five minutes on items that fall within the delegations of the Board provided the matters are not subject to legal proceedings, or to a process providing for the hearing of submissions. Speakers may be questioned through the Chairperson by members, but questions must be confined to obtaining information or clarification on matters raised by the speaker. The Chairperson has discretion in regard to time extensions.

Such presentations do not form part of the formal business of the meeting, a brief record will be kept of matters raised during any public forum section of the meeting with matters for action to be referred through the customer relationship management system as a service request, while those requiring further investigation will be referred to the Chief Executive.

|

4 June 2025 |

10 Reports

10.1 People and Wellbeing Report

File Number: A6748436

Author: Darren Crowe, People and Capability Manager

Authoriser: Adele Henderson, General Manager Corporate Services

|

That the People and Capability Manager’s report dated 4 June 2025 titled ‘People and Wellbeing Report’ be received. |

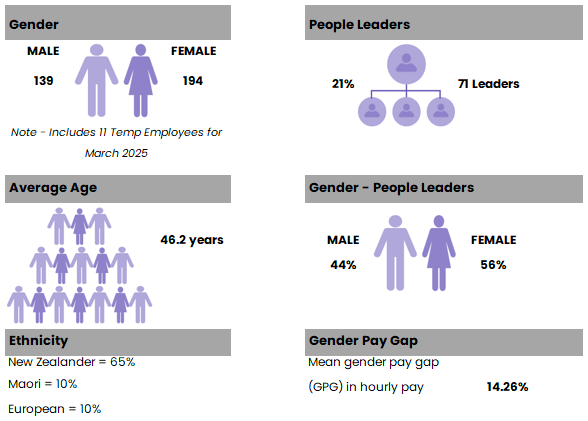

The People Experience section of this report provides a snapshot of the trends and demographics of our workforce over the three months from 1 January to 31 March 2025.

The past three months have been both busy and successful for the People Experience team. The ongoing implementation of Workday has placed additional pressure on the team due to tight delivery timelines, while still managing other key initiatives such as the leadership development programme and preparation for the 2025 remuneration review.

Key people metrics and insights for the period include:

- The total number of employees decreased by 9 from 342 to 333

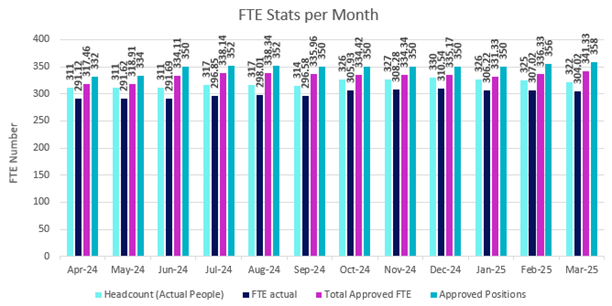

- The actual FTE level decreased from 310.54 to 304.02

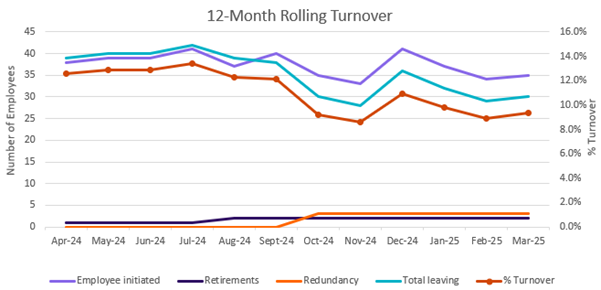

- Turnover decreased from 10.9% to 9.3%

- The average vacancy rate increased from 5.7% to 10.1%

- The absenteeism rate increased slightly from 2.81% to 3.56%

Some great results for the period with key people metrics continuing to trend in the right direction. It pleasing to see that we have maintained the low levels of absenteeism and turnover reported in the previous period.

People Leader Ratio

The number of people leaders increased slightly from 70 to 71 over the last quarter. People leaders represent 21% of our people and the ratio of people leaders to employees is 1 to 3.69.

Gender

Our gender distribution has changed slightly for this period. Fifty eight percent (58%) of our permanent and fixed-term workforce identify as female and 42% as male. For the second consecutive quarter, we report a slight difference in the distribution of gender within our people leaders, with 56% identifying as female and 44% identifying as male.

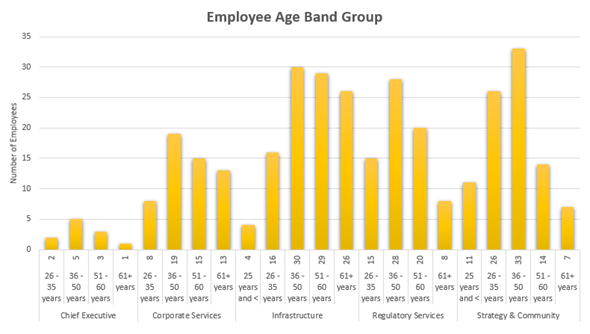

Age

Age demographics remains very consistent from quarter to quarter as we continue to report a slightly skewed distribution toward the higher age range. The average age of our people is 46.2 years with the 36-50 age group our most prevalent. People under 25 years of age continue to be lowly represented (12 in total) at 4% of total employees.

Age demographics remains as an emerging risk due to the impact our ageing workforce could have on the retention of institutional knowledge. This combined with our low attraction and retention rates of younger people, may impact our ability to deliver into the future.

Continuing trends include the high portion (25%) of the Infrastructure Group represented in the 61+ years age bracket, followed closely by Corporate Services group with (24%).

Gender Pay Gap

Our mean gender hourly pay gap has decreased slightly moving from 15.49% in March 24’ to 14.26% in March ‘25. At the end of Q2 Dec ‘25 our gender hourly pay gap was 14.15% which is consistent with this reporting period. The gender pay gap in New Zealand is currently 8.2% (as at June ’24). The gender pay gap helps provide an understanding of high-level indicators of the difference between women and men’s earnings, as well as the benefits of pay and employment equity.

Ethnicity (all employees including casual)

We currently employ 14 ethnicities captured as, African 9, American 1, Asian 4, Australian 6, Brazilian 2, Chinese 4, English 12, NZ/European 250, Indian 5, Māori 33, Pacific Peoples 5, and Scottish 1.

Leaders Ethnicity

We currently have 71 people leader roles across Council. The ethnic spread of our people leaders closely mirrors the overall ethnic distribution of the organisation. Of the 71 people leaders 77% identified as European/New Zealander while 10% identified as Māori. The remaining 13% is made up of 3% African, 1% American, 2% Australian and 4% English.

Workforce Capacity

The FTE approved level as at 31 March ‘25 was 341.33 (compared to 335.17 as at 31 Dec ‘24) and the actual FTE level was 304.02 (compared to 310.54 as at 31 Dec ’24). The actual permanent headcount was 322 (333 including fixed-term roles). As forecast, the actual headcount level reduced over this quarter due to a number of temporary roles ending.

The average vacancy rate increased to 10.1% for the quarter compared to 5.7% as at the same period last year (March ’24). The average vacancy rate increased by 4.4% over the period.

Recruitment decreased significantly for the period with three positions filled compared to 31 in the previous period (which included recruitment for the Transport structure and summer ambassadors).

Full Time Equivalents as at 31 March 2025 (excludes temporary positions)

Labour Market Snapshot

As forecast by many economists last year, the NZ unemployment rate now exceeds 5% reaching 5.1% as at the end of the Dec ‘24 quarter. This is an increase from the previous quarter's rate of 4.8%. Annually, unemployment rose by 33,000 to 156,000. The unemployment rate is projected to reach 5.6% for the period ending March ‘25, according to the NZIER. The Reserve Bank of New Zealand (RBNZ) anticipates a peak of 5.2% in the June quarter of 2025, before declining gradually.

National trends for job ads have remained relatively steady for some time, however of note, ad volumes increased by 2% for the first time since August 2022, indicating a stabilisation of the market. Applications per job ad continued to climb, rising a further 2% making for an extremely competitive market for candidates (Seek Employment Report March 2025).

We will continue to closely monitor the labour market as in the past, when the local economy and our communities come under pressure, there is potential for an escalation in antisocial behaviour.

As a result of the tightening market, we have seen a rise in the number of applications for each role. We continue to attract strong talent with the prerequisite skills and experience looking for their next role however, with the increasing number of applications, our focus will now be on managing the volume of applications and finding the good ones among the volume.

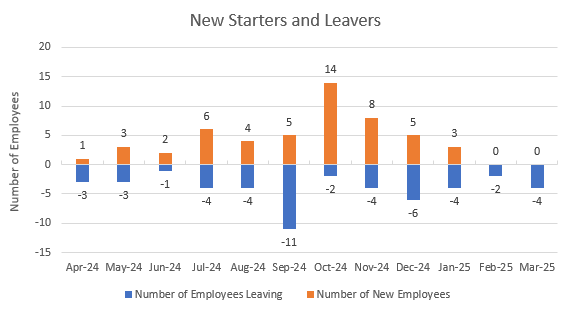

Starters and Leavers

We increased the number of employees by three in total over the quarter. Of note, there were no new employees in February and March. The employees on average leaving Western Bay over the last three months was three.

For the quarter ending March ‘25, we had 9 permanent employees, and one casual employee leave Western Bay. Five employees participated in exit interviews and the key themes from the exit interviews were:

- On average, our leavers rated Western Bay a 6.6/7 as a place to work.

- The main reasons for leaving were due to personal reasons (unrelated to work) and relocation.

Demographics of the 10 leavers included:

- 3 female and 7 male

- Age 25 and under: 1

- Age 35-50: 6

- Age 51-60: 2

- Age 61 and Over: 1

Tenure of leavers:

- Less than 1 year: 1

- 1-3 years: 6

- 5-10 years: 3

Turnover decreased in the March ’25 quarter to 9.3% compared to 10.9% in the Dec 24’ quarter. The yearly average was 12% as at Mar 25’ compared to 13.6% as at March ’24. The positive downward trend continues which is very pleasing.

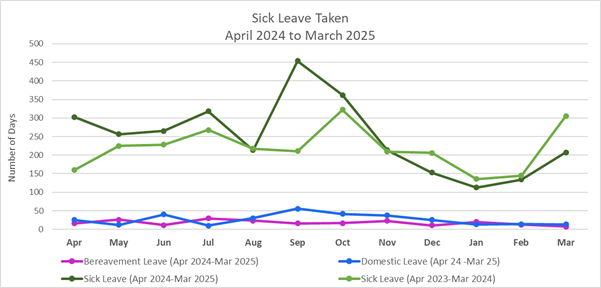

Sick leave taken can be defined as the annual recording of unexpected staff absences caused by sickness or other personal reasons.

Sick leave recorded for December ‘24 was 153 days, compared to 207 days in March ‘25, but still lower than March ‘24 with 306 days. The average number of sick leave days for the months Jan to Mar ’25 was 151.

The absenteeism rate increased slightly from 2.81% to 3.56%, which was to be expected, however still remains very low. The year-on-year comparison is down from 5.50% (March ‘24) to 3.56% (March ’25). It is very positive to see the low trend continue as we head into the winter months. The absenteeism rate is calculated using the average number of employees, multiplied by missed work days, divided by the average number of employees, multiplied by the total work days.

As at March ‘25, 10 employees had negative sick leave balances ranging from 5 to 10 days. There were 20 employees with over 10 days of negative sick leave, resulting in a total cost of just over $170,100 for Western Bay.

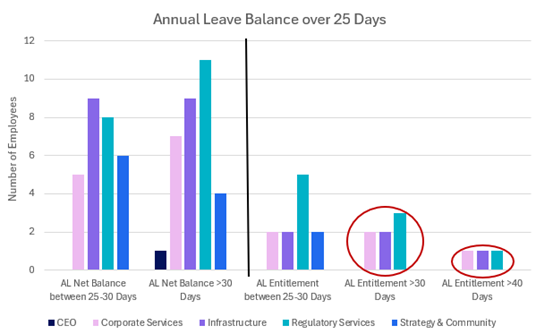

Annual Leave Balances Over 25 Days

We currently have three people with over 40 days of entitlement: One each from Corporate Services, Regulatory, and Infrastructure Groups.

The workday implementation is on track and progressing well. Project updates continue to be provided monthly through the Priority Project Governance (PPG) group.

Milestones completed during the last quarter include:

· Review and sign off end-to-end build workbooks

· Data migration and validation for end-to-end build

· Integrations complete

· Documented test scenarios and test scripts in preparation for end-to-end testing

· Preparation of training material, resources and tools to train People Experience team, people leaders, and staff.

We have completed the discovery and co-design phase of our leadership development initiative with Updraft.

Milestones completed during this phase:

· A clear and collectively shaped definition of what great leadership looks like at WBOPDC ‘Te Ara Wai – The Pathways of Water’

· A high-level plan for learning experiences that build skills and shape behaviours to bring the vision of leadership in all roles to life.

· Launch events planned for kick off on 2 May 2025. As of 28 April 2025, we have 246 staff registered to attend a launch session which is a fantastic effort.

Next steps:

· Confirm detailed design for learning experiences

· Launch intranet page

· Commence booking for the core and people leader learning experiences

· Define any ongoing support from the Updraft team for ELT

The People Experience Partners continue to work with People Leaders who are interested in completing this with their teams.

What is Insights Discovery?

Insights Discovery is a psychometric tool that uses a simple, four-color model to help us understand our personalities, work styles, and communication preferences. The model is based on the psychology of Carl Jung and helps us better understand ourselves and others.

How does it work?

Each of us has all four colour energies within us, and the combination of these energies forms our unique style. The tool provides a common language to discuss and appreciate our collective strengths and differences, helping us enhance our teamwork and communication.

What are the goals and outcomes we are trying to achieve?

· To enhance our own personal effectiveness - through increasing self-awareness and identifying our strengths.

· To enhance team effectiveness and cohesion - through a greater awareness and appreciation of different perspectives, increased knowledge of ways to connect and communicate with others and a common language to help discuss and resolve conflict where it arises.

· To positively contribute to an individual’s sense of belonging and feeling of being included and appreciated for who they are and the valuable contribution they bring to work.

· To enhance communication and collaboration with stakeholders, community and our partners by using the skills learnt to spot other’s communication style and adapt our own behaviour to better connect.

Status Update

As of 28 April 2025, 174 people have an Insights profile, 24 teams have participated in a team workshop (some combined) and 17 workshops have been held since the start of the roll out.

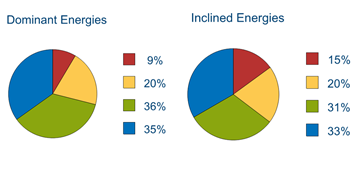

Below is a snapshot of the Insights colour energy preferences from all those who have completed a profile so far. We have noted some key observations that might be helpful when thinking about communication, engagement and decision making:

· Approximately one third of people have 3 colour energies above the line, nearly two thirds have 2 colours above the line reinforcing the concept that we have multiple colour energy preferences, not just one.

· On the inclined energies (colours above the line), over two thirds have an introverted preference (green and blue).

· There is an even split between the thinking preference 48% (red and blue) and feeling preference 51% (green and yellow).

· Red is the lowest colour energy preference.

Consolidated team wheel for all of organisation to date

LinkedIn Learning

77% of our available licences have been activated. In the past 90 days, 16% of users have viewed content with an average of 1 hour per viewer. 16 learners have engaged with LinkedIn Learning’s AI powered features (AI Powered Coach) in the last 90 days. The most popular topics continue to be time management, project management and Microsoft Excel and we have seen an increase in People Management skills (conducting one to ones, leading meetings, daily habits for people management).

The Project Base Camp team is collaborating with LinkedIn Learning to integrate LinkedIn resources into the staff's learning experience during the rollout of the new Project Management Framework.

Our strategic focus continues to include improving health, safety and wellbeing knowledge, behaviours and outcomes for our people by empowering them to actively contribute to, and participate in, safety leadership.

As part of our ongoing response to the recommendations from Pillar Consulting, a new Risk Management training module has been developed and delivered to the Infrastructure Group through our online induction and training portal.

This module provides a foundational understanding of key risk concepts — hazards, risks, and controls — all contextualised through a Western Bay lens to ensure relevance and practical application.

While the initial focus was on addressing Infrastructure-specific recommendations, the module has been developed with scalability in mind:

· It is well-suited for organisation-wide rollout

· It is intended to become a standard component of our onboarding programme, supporting consistency in our approach to risk awareness and management across all teams

This initiative reflects our commitment to embedding a strong, shared understanding of risk and safety as a core part of our workplace culture.

Our leaders continue to actively manage team training requirements using the Vault health and safety management system. While we await the implementation of our new HRIS system, which will support training management, we are reinvigorating a project to ensure Vault is accurately capturing training needs. This work aims to better support leaders in proactively overseeing and fulfilling their teams’ development and compliance obligations.

With the addition of several new team members in Customer Services, we’ve reactivated the comprehensive 9-module Conflict Management and De-escalation course delivered by WARN International. To maintain a consistent skill level across the team, refresher training has been offered to all existing staff who previously completed the course. This initiative aligns with our proactive approach to managing Critical Risks, particularly those related to frontline interactions

Recognising individual needs is key to keeping our people safe. During this period, we facilitated driver awareness and confidence training for a team member who identified challenges in this area. By partnering with a new provider, the session led to increased confidence and very positive feedback. This initiative directly supports one of our four identified Critical Risks. These efforts demonstrate our ongoing commitment to early intervention, tailored support, and embedding safety as a shared responsibility across the organisation.

As we continue to build a deeper understanding of the projects our teams are delivering, there has been a deliberate focus on increasing on-site engagement. This includes spending more time alongside our teams and contracting partners to support the safe and successful delivery of projects.

Using the Vault Check system, a number of project sites were visited and reviewed to assess safety performance, strengthen collaboration, and identify opportunities for continuous improvement.

Sites visited include:

- Waihi Beach Library build

- Athenree Water Treatment Plant build

- Wharawhara Water Treatment Plant build

- Katikati Wastewater Treatment Plant build

- Waitekohekohe suspension bridge build

- CS7 Bore installation

This approach reinforces our commitment to visible safety leadership, partnership with contractors, and ensuring that health and safety is embedded in every stage of project delivery.

As reported in the media, the Minister for Workplace Relations and Safety announced a series of proposed changes to Health and Safety at Work Act. The proposed changes are expected to be presented to Parliament later this year, with a view to enactment in early 2026. The changes include:

|

Initial Proposed Change |

Impact to Council |

|

Reduced H&S requirements on small business |

Negligible for our Operations, but may impact some Contractor engagement |

|

Free up landowners from liability in 3rd party activities |

To be determined. Possibly TECT Park, events on Council land, and use of our cycleways and walkways etc. |

|

Director focus shifts to governance and oversight, rather than day to day management |

Minimal. Council operates more to this model than the opposite. |

|

Greater use of Approved Codes of Practice, compliance which supplements the HSWA. |

Minimal. Some ACOP will apply to our operations, however it is not expected that much change to operations will be required to comply. |

|

Increased focus on Critical Risk management |

Minimal. We have started this journey. |

|

Reducing regulator notification requirements |

No change |

|

Creation of a hot line for excessive road cone use |

We are already underway with transitioning our understanding to the new Guide to Temporary Traffic Management, which will address this. |

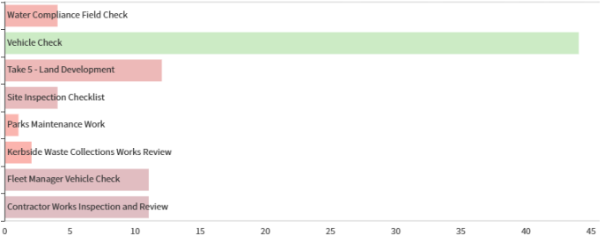

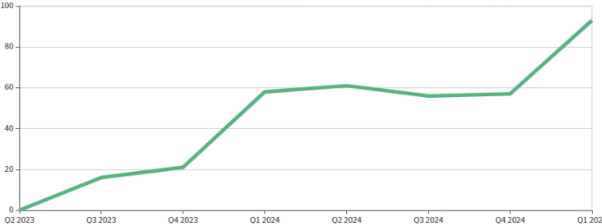

Our teams completed the highest number of recorded checks within the quarter of all time, entering 90 into the Vault Check system. This compares to a reasonably consistent volume of 55-60 checks per quarter in the 12 months prior.

This is a good demonstration of increased engagement from our team members with our contracting partners, as well as a continued improvement in checking the safe condition of our vehicles by completing Vehicle Checks.

These checks identified some corrective actions which have been assigned to the relevant people, however there was nothing of a concerning nature identified during the checks.

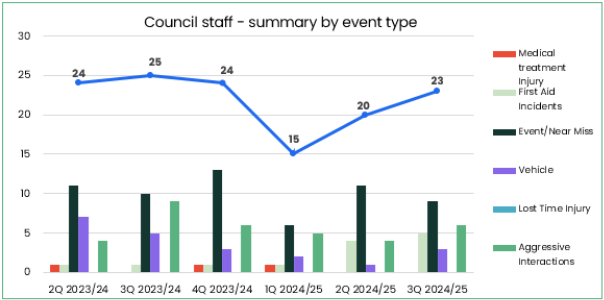

Our people were involved in no notable events, although exposure to aggressive or threatening behaviour was the highest recorded event type (7 of 24). Five events required some sort of First Aid treatment, with the remaining being No Treatment / Report Only events. There was no identifiable trend from incidents involving Western Bay staff during the quarter, outside of the aggressive/abusive customer interactions (which were all verbal only).

Within our contracting partners, there was three high potential events reported.

Truck

Rollover Incident

A chip seal truck, moving slowly in the late afternoon sun with the hoist

raised, tipped over due to the road’s significant camber. The road edge

gave way slightly, destabilising the truck, which tipped into the bank.

Fortunately, there were no injuries or major vehicle damage. The contracting

partner has since revised their chip sealing procedures for roads with steep

cambers, focusing on truck positioning, hand chipping on soft shoulders, and

hoist height. Staff have been trained on these new processes.

Work

at Height Without Fall Protection

A Working at Height trained contractor was observed on CCTV working on a roof

without fall protection, despite the height exceeding 2m. A joint investigation

identified gaps in job planning and risk assessment. The contractor has

committed to improving these processes, and Western Bay will closely monitor

future work to ensure compliance. A Safety Alert has been issued to project and

contract managers for distribution to relevant contractors.

Ratchet

Strap Failure – Thumb Injury

A contractor suffered a thumb injury when a ratchet strap failed while

tensioning a steel installation, causing the steel hook to recoil and strike

the worker. The impact caused lacerations, bruising, and nail damage.

Fortunately, it didn’t strike a more vulnerable area, like the face or

head. The investigation revealed that the ratchet straps were not regularly

inspected despite exposure to harsh environmental conditions. The contractor

has replaced all straps and introduced a regular inspection schedule. A Safety

Alert was shared internally and externally to raise awareness.

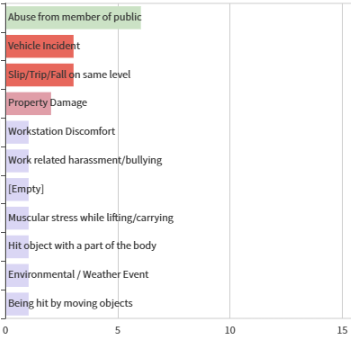

Our People Events - Trends

As noted above, exposure to aggressive or threatening behaviour was the highest contributor in terms of event types (7 of 24). All of these interactions were verbal in nature, and required no medical treatment for impacted staff. Of the remaining events, five required First Aid treatment, with the remaining being No Treatment / Report Only events. Outside of the aggressive/abusive customer interactions, there was no identifiable trend from incidents involving Western Bay staff during the quarter.

Mechanism of Event – Previous Quarter

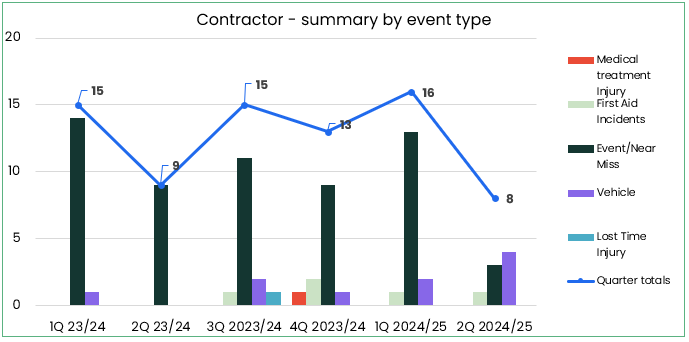

Contractor Events

Contractor events increased compared to the previous quarter from 8 to 18. This is not necessarily a negative trend however, as it can show a closer relationship between Council and our contracting partners and may also align with more contractors becoming aware of our reporting expectations through the induction process.

Lead Indicators

Inspections completed by our people continue to remain

higher than the same period last year, capping off a very positive rise in

check completed during the calendar year by the teams.

Continuing this momentum will be key as we seek to act on Pillar’s recommendations and implement some targets and KPIs around completing these checks.

Inspections

Inspections completed by month – last 12 months

Near Miss Reporting

Lag Indicators (Accident/Incident Frequency Rates)

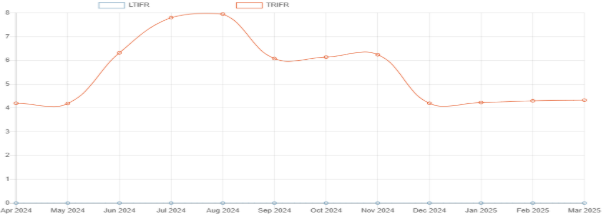

Total Recordable Injury Frequency Rate (TRIFR) remained steady through the quarter, noting that there was a discrepancy with the December 2024 TRIFR in the previous report (due to hours in the system).

The TRIFR remains at an acceptably low rate.

Lost Time Injury Frequency Rate (LTIFR) remains at 0.00.

NB: A reminder that these frequency rates do not include contractors, as we do not accurately record their hours.

Albeit to a lower degree this year due to the funding model changing within the Aotearoa Bike Month Challenge, we again offered bike servicing and group rides through Aotearoa Bike Month. In lieu of the official competition, an online group was established for people to capture their rides, with spot prizes available

Staff were invited to information sessions regarding KiwiSaver and the SuperEasy scheme available to local government staff. These were well attended.

My Everyday Wellbeing (MEW) continue

to provide good wellbeing resource for our teams, and they have provided

engagement statistics for the previous six months.

· We used the platform 1,135 times during the 6 month period, hitting 4,287 individual pages in the process.

· 54% of our staff are using the platform outside of the Western Bay network, indicating there is value being gained while at home also.

· 56% of staff open health and fitness related emails from MEW (compared to a benchmark of 15%)

MEW’s live webinars continue to be attended by our people also.

Smaller staff groups are creating special interest groups among peers to enhance inclusivity, physical and mental wellbeing, notably the weekly Run Club from Barkes Corner, and a group of golfing enthusiasts regularly engaging in twilight golf.

|

4 June 2025 |

10.2 Audit Management Report 2023/24

File Number: A6699018

Author: Jonathan Fearn, Chief Financial Officer

Authoriser: Adele Henderson, General Manager Corporate Services

Executive Summary

1. The purpose of this report is to provide Elected Members an opportunity to review the Audit Management Report on the audit of Western Bay of Plenty District Council for the year ended 30 June 2024.

|

That the Chief Financial Officer’s report dated 4 June 2025 titled ‘Audit Management Report 2023/24’ be received. |

Background

2. The final audit Management Report (the report) was issued on 07 May 2025 and has been reviewed by the Management Team. Management comments have been provided setting out proposed actions and areas for improvement in response to audit findings provided in the report.

Audit New Zealand issued an unmodified audit report on 18 February 2025. This means that Audit New Zealand was satisfied with the financial statements and statement of service performance fairly reflected Council’s activity for the year and financial position at the end of the year.

3. Matters raised in Audit New Zealand’s audit plan, together with other findings and areas of focus, are noted in sections 3 (page 13) and section 4 (page 13) of the report.

1. Audit

Management Report 2023/24 ⇩ ![]()

|

4 June 2025 |

10.3 Outstanding Recommendations Register - May 2025

File Number: A6723455

Author: Darren Crowe, People and Capability Manager

Authoriser: Adele Henderson, General Manager Corporate Services

Executive Summary

The Outstanding Recommendations Register (ORR) is to provide the Committee with a progress report on all the recommendations raised through various external and internal audits/reviews. The audits/reviews that are currently in the ORR are recommendations from the following audits/reviews carried out:

· Audit New Zealand Report for the year ended 30 June 2024.

· Cash Controls Review - Report released on 21 December 2022.

· PWC Fringe Benefit Tax (FBT) Audit Report.

· PWC GST Audit Compliance Evaluation

|

That the People and Capability Manager’s report dated 4 June 2025 titled ‘Outstanding Recommendations Register - May 2025’ be received. |

Background

1. Council maintains a register of recommendations arising from internal and external audits. Each recommendation which follows from a finding that was identified from the audit/review has a management comment.

2. Risk and Assurance Team have carried out the update on the register and obtained feedback from management who are responsible for the area the audit/review that was undertaken and closed where appropriate.

3. Not all recommendations need to be actioned immediately and are assessed and actioned on a priority basis.

1. Outstanding

Recommendations Register June 2025 ⇩ ![]()

|

4 June 2025 |

10.4 Financial Performance Update - 30 April 2025

File Number: A6780485

Author: Sarah Bedford, Finance Manager

Authoriser: Jonathan Fearn, Chief Financial Officer

Executive Summary

This report also provides the Audit, Risk and Finance Committee with any current Treasury Policy breaches in relation to interest rate hedging, as identified in previous financial reports.

|

That the Finance Manager’s report dated 4 June 2025 titled ‘Financial Performance Update – 30 April 2025’ be received. |

Summary - financials

The following is a summary of the financial performance for the period ended 30 April 2025 along with associated financial statements and analysis in Attachment 1.

1. The current budgets per the adopted annual plan have been phased to best reflect forecasted timings by budget managers.

2. Full details and analysis are provided in Attachment 1.

3. The below table is a summary of financial performance for the ten months ended 30 April 2025.

|

Statement of comprehensive revenue and expense |

Actual $000’s |

Budget YTD $000’s |

Variance $000’s |

|

Revenue |

159,624 |

155,780 |

3,843 |

|

Expense |

118,831 |

121,114 |

2,284 |

|

Surplus/(deficit) |

40,793 |

34,666 |

6,127 |

|

Total Revenue - Actual YTD vs Full Year Budget |

83% |

||

|

Total Expenses - Actual YTD vs Full Year Budget |

82% |

||

|

Statement of financial position |

Actual YTD

$000’s |

Budget Full Year $000’s |

|

|

Assets |

2,048,373 |

2,139,995 |

|

|

Liabilities |

214,457 |

209,795 |

|

|

Equity |

1,833,916 |

1,930,200 |

|

4. Financial Performance - The overall financial results show a surplus to date of $40.8m, this is $6.1m ahead of year-to-date budget.

5. Balance Sheet - As at April council’s assets are 96% of full year budget. Council’s liabilities are 108% compared to budget mainly due to recognition of payables and deferred revenue.

6. Capital Expenditure - Total capital expenditure spend of $94.2m is reported against a full year budget of $161.8m. This represents 58.2% capital expenditure spent of the full year budget. The infrastructure team continue to forecast a 90% completion rate by the end of the financial year.

7. Treasury - As at 30 April 2025, Council has undertaken $45 million in net new borrowings year-to-date and remains within its policy limits for counterparty exposure, debt, interest, and liquidity ratios. However, a breach of the interest rate hedging policy remains for the 2–5 year timeframe, with non-compliance forecast at the end of 2026 and 2028.

In April, Council refinanced $25 million of maturing debt, of which $15 million was secured at a fixed rate. In addition, $15 million of new fixed cover was transacted at the end of May 2025. This has brought the 0–2 year hedge bucket into compliance.

To address the remaining hedging shortfall beyond the 3-year mark, Council will continue to implement forward starting swaps. These instruments will help close the gap without impacting the 2026 financial year’s average cost of funds.

1. Financial

Report - 30 April 2025 ⇩ ![]()

|

4 June 2025 |

10.5 Review of Accounting Policies and Key Accounting Judgements - Annual Report 2024/25

File Number: A6664028

Author: Sarah Bedford, Finance Manager

Authoriser: Jonathan Fearn, Chief Financial Officer

Executive Summary

The purpose of this report is to provide the Committee with a high-level summary on key changes to accounting policies and treatment for the 30 June 2025 Annual Report.

|

That the Finance Manager’s report dated 4 June 2025 titled ‘Review of Accounting Policies and Key Accounting Judgements – Annual Report 2024/25’ be received. |

Accounting Policies

Key amendments to policies

2. Update of Three Water Reform disclosure

Key Amendments to ACCOUNTING STANDARDS

PBE IPSAS 1

3. This amending Standard sets out amendments to PBE IPSAS 1 Presentation Financial Reports. The amendments require an entity to describe the services provided by its audit or review firm and to disclose the fees incurred by the entity for those services.

4. Entities must now disclose:

a. Fees to each audit firm for the audit of financial statements.

b. Fees for other services provided by each audit firm.

c. These disclosures must be broken down by type of service e.g. assurance services, tax services, consulting and whether the service is related to the audit or not.

2024 omnibus amendments to pbe standards

5. The 2024 Omnibus Amendments include updates to PBE IPSAS 1 Presentation of Financial Reports to clarify the principles for classifying a liability as current or non-current. The amendments are effective from reporting periods beginning on or after 1 January 2026. Adoption of this standard will not result in any significant impact on the Council financial statements.

Key Accounting Estimates

6. At this stage there are no matters to draw to the Committee’s attention regarding key accounting estimates.

1. Proposed

Accounting Policies 2024-25 Annual Report ⇩ ![]()

|

4 June 2025 |

10.6 Proposed sale of Zespri and Seeka shares

File Number: A6735099

Author: Jackson Jury, Financial Analyst

Authoriser: Jonathan Fearn, Chief Financial Officer

Executive Summary

1. Western Bay of Plenty District Council currently holds share investments in Zespri Group Ltd and Seeka Ltd. As part of the Council’s broader financial strategy to review non-core assets and strengthen liquidity, management is recommending that Council consider the sale of these shares.

|

1. That the Financial Analyst’s report dated 4 June 2025 titled ‘Proposed Sale of Zespri and Seeka Shares’ be received. 2. That the report relates to an issue that is considered to be of low significance in terms of Council’s Significance and Engagement Policy. 3. That Council approves the sale of all of the Zespri and Seeka shares. OR 4. That Council does not approve the sale of all of the Zespri and Seeka shares. 5. That the proceeds from the sale of the shares be put to the General Rates Reserve (if approved) |

Background

2. Western Bay of Plenty District Council currently holds share investments in both Zespri Group Ltd and Seeka Ltd. These shares were not acquired through a deliberate investment strategy, but rather as a consequence of Council’s historical purchase of strategic properties that included operational kiwifruit orchards. The Zespri shares were likely acquired as part of the original land and orchard purchases, while the Seeka shares have likely been issued over time through Council’s ongoing ownership of the orchards, with Seeka providing shares as an incentive annually to its growers.

3. Council currently holds 26,490 shares in Zespri Group Ltd and 11,247 shares in Seeka Ltd. As at the end of April 2025, Zespri shares were trading at $6.21 each and Seeka shares at $3.78 each, equating to an approximate market value of $164,500 and $42,500 respectively. In accordance with Section 5.4.1 of the Council’s Treasury Policy, the disposal of shares where the market value exceeds $50,000 requires Council approval.

4. As part of its ongoing financial management, Council has the opportunity to consider whether continuing to hold these shares remains appropriate. While the shares have provided dividend income and potential capital gains, they also expose Council to market volatility and are not directly linked to the delivery of Council’s core services and strategic outcomes.

5. Please find a brief dividend history for Councils consideration below:

|

Year |

Councils Zespri Dividend |

Councils Seeka Dividend |

|

2023/24 |

$22,516 (85 cents per share) |

$1,687 (15 cents per share) |

|

2022/23 |

$30,993 ($1.17 per share) |

$0 (no dividend declared) |

|

2021/22 |

$47,152 ($1.78 per share) |

$1,462 (13 cents per share) |

6. Selling the shares would release additional liquidity, providing flexibility to fund high-priority projects, reduce debt, or strengthen Council’s financial resilience. Alternatively, Council may choose to retain the shares if it considers the investment returns and strategic position of the assets remain beneficial. Management is presenting this matter for Council’s consideration as part of its broader review of non-core assets.

Significance and Engagement

7. The Local Government Act 2002 requires a formal assessment of the significance of matters and decision in this report against Council’s Significance and Engagement Policy. In making this formal assessment there is no intention to assess the importance of this item to individuals, groups, or agencies within the community and it is acknowledged that all reports have a high degree of importance to those affected by Council decisions.

8. The Policy requires Council and its communities to identify the degree of significance attached to particular issues, proposals, assets, decisions, and activities.

9. In terms of the Significance and Engagement Policy this decision is considered to be of low significance because it is financially minor relative to Council’s overall budget, does not affect levels of service or strategic assets, and has minimal impact on the community.

Issues and Options Assessment

|

Option A Sell the shares |

|

|

Assessment of advantages and disadvantages including impact on each of the four well-beings · Economic · Social · Cultural · Environmental |

Economic: · Advantage: Immediate cash injection (~$207,000) and could be put to the General rates reserve. · Disadvantage: Loss of future dividend income and potential capital gains. Social: · Advantage: Frees up funds that can be used for projects or services that directly benefit the community. · Disadvantage: Minimal; the shares are not directly linked to service delivery. |

|

Costs (including present and future costs, direct, indirect and contingent costs). |

Present cost is the loss of potential future returns (dividends/capital growth). No direct or indirect financial costs associated with the sale aside from a small brokerage fee. Potential opportunity cost if the shares appreciate significantly in the future. |

|

Other implications and any assumptions that relate to this option (Optional – if you want to include any information not covered above). |

Assumes that selling can be completed at or near current market value without significant transaction costs. Assumes the funds can be better utilised in core Council activities aligned with community outcomes. |

|

|

|

|

Option B Keep the shares |

|

|

Assessment of advantages and disadvantages including impact on each of the four well-beings · Economic · Social · Cultural · Environmental |

Economic: · Advantage: Retains exposure to future dividend income and potential capital gains. · Disadvantage: Continues exposure to market risk and ties up funds that could be applied to core Council functions. Social: · Advantage: None directly. · Disadvantage: Missed opportunity to reinvest funds into services that directly benefit the community. |

|

Costs (including present and future costs, direct, indirect and contingent costs). |

Risk of declining share value or reduced dividends, affecting future returns. |

|

Other implications and any assumptions that relate to this option (Optional – if you want to include any information not covered above). |

Assumes the orchard operations and related industries remain stable to support share value. Time bound sale option depending on whether we are still in the market of kiwifruit. Assumes the dividend returns continue to be relatively modest and do not significantly alter Council’s financial position. |

Statutory Compliance

10. The sale is permissible under the LGA 2002 because:

· The shares are not in a CCO (Section 80 does not apply).

· The council has general authority to dispose of property (Section 12).

· The sale is financially prudent (Sections 100–102).

· No mandatory public consultation is required for this transaction.

Funding/Budget Implications

|

Budget Funding Information |

Relevant Detail |

|

|

If Council chooses to sell, there will be a small brokerage cost to Council. |

|

4 June 2025 |

11 Information for Receipt

11.1 Local Government Official Information Request - Quarter 4 Report (2024/25)

File Number: A6736143

Author: Lizzie McEwan, Executive Assistant and Privacy and Official Information Advisor

Authoriser: Rachael Davie, Deputy CEO/General Manager Strategy and Community

Executive Summary

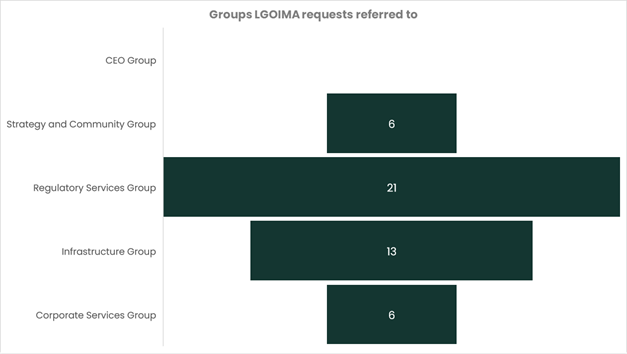

1. The purpose of this report is to provide appropriate data to the Committee on all official information requests received under the Local Government Official Information and Meetings Act 1987 (LGOIMA) for quarter 3 of the 2024/2025 financial year.

Latest published responses

2. The table below shows the published responses to information requests during quarter 3 of the 2024/2025 financial year.

The number of requests received has decreased by 22% since the same quarter of the 2023/2024 financial year.

|

|

January 2025 |

February 2025 |

March 2025 |

Total |

|

LGOIMA received |

13 |

13 |

20 |

46 |

|

LGOIMA decision sent within statutory timeframe (20 business days) |

13 |

12 |

16 |

41 |

|

Number of responses published |

0 |

1 |

2 |

3 |

|

Average working days taken to make decision |

9 |

12 |

16 |

- |

|

LGOIMA extensions |

0 |

0 |

1 |

1 |

|

LGOIMA refused in full |

1 |

0 |

2 |

3 |

|

LGOIMA partially withheld or refused |

3 |

4 |

3 |

10 |

|

LGOIMA transferred to another agency |

0 |

0 |

0 |

0 |

Summary of responses

3. The table below shows a summary of the requested information along with Council’s response to each under LGOIMA for quarter 3 of the 2024/2025 financial year.

|

Month |

Subject |

Group |

|

January |

Housing needs and developments |

Strategy and Community Group |

|

January |

Building consent data |

Regulatory Services Group |

|

January |

Representation review submissions |

Strategy and Community Group |

|

January |

Residential property - Fire hazard information |

Regulatory Services Group |

|

January |

Dog and animal control funding |

Regulatory Services Group |

|

January |

Residential property - Fire hazard information |

Strategy and Community Group |

|

January |

Te Puna Station Road - Environment Court Hearing Details |

Strategy and Community Group |

|

January |

Resource consent application - Glen Isla Protection Society (GIPS) |

Infrastructure Services Group |

|

January |

Residential property information |

Regulatory Services Group |

|

January |

Water treatment plant reports and certification |

Infrastructure Services Group |

|

January |

File of complaints and allegations against neighbour |

Regulatory Services Group |

|

Month |

Subject |

Group |

|

January |

District Court decision - Bledisloe Park |

Infrastructure Services Group |

|

January |

Residential property - Noise control report |

Regulatory Services Group |

|

February |

Drinking water research |

Infrastructure Services Group |

|

February |

Off-licences data |

Regulatory Services Group |

|

February |

Three Mile Creek - Consent conditions compliance |

Infrastructure Services Group |

|

February |

Copies of correspondence between parties pertaining to Te Puna Station Road |

Regulatory Services Group |

|

February |

Hairdressing salons and barber shop data |

Regulatory Services Group |

|

February |

Residential property - Original land swap proposal document |

Regulatory Services Group |

|

February |

Building consent data |

Regulatory Services Group |

|

February |

Residential property – copies of complaints made to Council |

Regulatory Services Group |

|

February |

Dog impound information |

Regulatory Services Group |

|

February |

Decisions on silica and water quality in Ōmokoroa |

Infrastructure Services Group |

|

February |

Annual budget figures for the cost of running Community Boards |

Corporate Services Group |

|

February |

Petitions data |

Strategy and Community Group |

|

February |

Water treatment plant reports and certification |

Infrastructure Services Group |

|

March |

Land use consents in the Minden since 2022 |

Regulatory Services Group |

|

March |

Roading works at Apata Station Road |

Infrastructure Services Group |

|

March |

History of Kuka Road, Te Puna |

Corporate Services Group |

|

March |

Average cost of rates |

Corporate Services Group |

|

March |

Pedestrian crossings |

Infrastructure Services Group |

|

March |

Three Mile Creek – Hearing process |

Infrastructure Services Group |

|

March |

Music licensing fees |

Corporate Services Group |

|

March |

Residential property – Application to build |

Regulatory Services Group |

|

March |

Elections data |

Strategy and Community Group |

|

March |

Rates and resource consent payments |

Corporate Services Group |

|

March |

TECT Park – Lease agreements |

Infrastructure Services Group |

|

March |

Dangerous, affected, and insanitary buildings |

Regulatory Services Group |

|

Month |

Subject |

Group |

|

March |

Residential property – Resource consents |

Regulatory Services Group |

|

March |

Mixed-use rural drinking water supplies |

Infrastructure Services Group |

|

March |

Sawmill resource consent |

Regulatory Services Group |

|

March |

Liquor license data |

Regulatory Services Group |

|

March |

Cost to repair potholes |

Infrastructure Services Group |

|

March |

Cost of Council projects |

Corporate Services Group |

|

March |

Residential property – Through road plans |

Regulatory Services |

|

March |

Resource Management (Discount on Administrative Charges) Regulations 2010 |

Regulatory Services |

Privacy requests and breaches

4. Only one request for private information was received during the month of January for quarter 3. This response was responded to in full and within the legislative timeframe of 20 business days.

5. A privacy breach occurs when an organisation or individual either intentionally or accidentally:

a) Provides unauthorised or accidental access to someone's personal information.

b) Discloses, alters, loses, or destroys someone's personal information.

c) A privacy breach also occurs when someone is unable to access their personal information due to, for example, their account being hacked.

6. Under the Privacy Act 2020, we are required to report all privacy breaches that either has, or is likely to, cause anyone serious harm to the Privacy Commissioner.

7. Seven breaches of privacy have occurred and been reported as minor for quarter 3 of the 2024/2025 financial year. These breaches are outlined in the table below.

|

Month |

Breach detail |

Number of persons affected |

Classification |

Reported to the Privacy Commissioner |

|

February |

Email error – Incorrect recipient |

1 |

Minor |

N/A |

|

February |

Email error – Incorrect recipient |

1 |

Minor |

N/A |

|

March |

Postal error – Incorrect recipient |

1 |

Minor |

N/A |

|

March |

Email error – Incorrect recipient |

1 |

Minor |

N/A |

|

Month |

Breach detail |

Number of persons affected |

Classification |

Reported to the Privacy Commissioner |

|

March |

Email error – Incorrect recipient |

1 |

Minor |

N/A |

|

March |

Postal error – Incorrect recipient |

1 |

Minor |

N/A |

|

March |

Email error – Incorrect recipient |

1 |

Minor |

N/A |

ombudsman complaints

8. There are no complaints received or open for investigation by the Office of the Ombudsman for quarter 3 of the 2024/2025 financial year.

|

4 June 2025 |

12 Resolution to Exclude the Public

RESOLUTION TO EXCLUDE THE PUBLIC

|

That the public be excluded from the following parts of the proceedings of this meeting. The general subject matter of each matter to be considered while the public is excluded, the reason for passing this resolution in relation to each matter, and the specific grounds under section 48 of the Local Government Official Information and Meetings Act 1987 for the passing of this resolution are as follows:

|