|

Projects and Monitoring Committee Kōmiti Whakakaupapa me Aroturuki

PMC25-1 Thursday, 20 March 2025, 9.30am Council Chambers, 1484 Cameron Road, Tauranga

|

|

Projects and Monitoring Committee Kōmiti Whakakaupapa me Aroturuki

PMC25-1 Thursday, 20 March 2025, 9.30am Council Chambers, 1484 Cameron Road, Tauranga

|

|

20 March 2025 |

Projects and Monitoring Committee

Membership:

|

Chairperson |

Cr Don Thwaites |

|

Deputy Chairperson |

Cr Allan Sole |

|

Members |

Cr Tracey Coxhead Cr Grant Dally Mayor James Denyer Cr Murray Grainger Cr Anne Henry Cr Rodney Joyce Cr Margaret Murray-Benge Cr Laura Rae Deputy Mayor John Scrimgeour Cr Andy Wichers |

|

Quorum |

Six (6) |

|

Frequency |

Quarterly |

Role:

· To monitor and review the progress of the Council’s activities, projects and services.

Scope:

· To monitor the effectiveness of Council and agency service agreements / contracts.

· To monitor the implementation of Council’s strategies, plans and policies, and projects as contained in the Long Term Plan or Annual Plan.

· To monitor agreements between Tauranga City Council and Western Bay of Plenty District Council and recommend to the respective Councils any changes to agreements, as appropriate.

· To monitor the on-going effectiveness of implemented joint projects, plans, strategies and policies with Tauranga City Council.

· To monitor performance against any Council approved joint contracts with Tauranga City Council and/or other entities.

· Monitor performance against the Priority One approved contract.

· Subject to agreed budgets and approved levels of service, make decisions to enable delivery of the operational and capital programme of Council.

Power to Act:

To make decisions to enable and enhance service delivery performance, in accordance with approved levels of service and subject to budgets set in the Long Term Plan or any subsequent Annual Plan.

Power to Recommend:

To make recommendations to Council and/or any Committee as it deems appropriate.

Power to sub-delegate:

The Committee may delegate any of its functions, duties or powers to a subcommittee, working group or other subordinate decision-making body, subject to the restrictions on its delegations and provided that any sub-delegation includes a statement of purpose and specification of task.

|

Projects and Monitoring Meeting Agenda |

20 March 2025 |

Notice is hereby given that an Projects and Monitoring

Meeting will be held in the Council Chambers,

1484 Cameron Road, Tauranga on:

Thursday, 20 March 2025 at 9.30am

9.1 Petition to halt the construction of a public toilet in the Precious Family Reserve, Ōmokoroa

10.1 Operational risk and scorecard report quarterly update ending 31 December 2024

10.2 2025/26 Procurement Strategy

10.3 Residual Town Centre Development Funds

10.4 Proposal to name the Waihī Beach Library and Community Hub

10.5 Development Trends Report 2024 Overview

|

Whakatau mai te wairua Whakawātea mai te hinengaro Whakarite mai te tinana Kia ea ai ngā mahi

Āe |

Settle the spirit Clear the mind Prepare the body To achieve what needs to be achieved. Yes |

2 Present

Members are reminded of the need to be vigilant and to stand aside from decision making when a conflict arises between their role as an elected representative and any private or other external interest that they may have.

A period of up to 30 minutes is set aside for a public forum. Members of the public may attend to address the Board for up to five minutes on items that fall within the delegations of the Board provided the matters are not subject to legal proceedings, or to a process providing for the hearing of submissions. Speakers may be questioned through the Chairperson by members, but questions must be confined to obtaining information or clarification on matters raised by the speaker. The Chairperson has discretion in regard to time extensions.

Such presentations do not form part of the formal business of the meeting, a brief record will be kept of matters raised during any public forum section of the meeting with matters for action to be referred through the customer relationship management system as a service request, while those requiring further investigation will be referred to the Chief Executive.

|

20 March 2025 |

9 Petitions

9.1 Petition to halt the construction of a public toilet in the Precious Family Reserve, Ōmokoroa

File Number: A6681401

Author: Rosa Leahy, Senior Governance Advisor

Authoriser: Robyn Garrett, Governance Manager

Executive Summary

A petition to halt the construction of a public toilet in the Precious Family Reserve, Ōmokoroa was received on 10 March 2025. Under Standing Orders, petitions may be presented to the relevant Committee for receipt.

|

1. That the petition to halt the construction of a public toilet in the Precious Family Reserve, Ōmokoroa dated 10 March 2025 be received. |

1. Petition

to halt construction of a public toilet in the Precious Family Reserve,

Ōmokoroa ⇩ ![]()

|

20 March 2025 |

10 Reports

10.1 Operational risk and scorecard report quarterly update ending 31 December 2024

File Number: A6652922

Author: Terri Wright, Transportation Administrator

Authoriser: Cedric Crow, General Manager Infrastructure Services

Executive Summary

The purpose of this report is to present the Scorecard report for Quarter 2 ending 31 December 2024, and to advise the Projects and Monitoring Committee on Infrastructure and Regulatory matters.

|

That the Transportation Administrator’s report dated 20 March 2025 titled ‘Operational Risk and Scorecard Report Quarterly Update Ending 31 December 2024’ be received. |

Background

SCORECARD REPORT

The Scorecard report for the period ending 31 December 2024 is attached, refer to Attachment 1.

Background

The Scorecard Report provides an overview of key achievements, update on Strategic Priorities, Capital Works Programme and Quarterly Development Trends for the period from 1 October to 31 December 2024. Listed below are the key highlights:

· Commencement of the Waihī Beach Library project and the continuing construction of the Heron Crescent elder housing development. Both significant community projects remain on track for completion and within budget.

· The No.4 Rd bridge replacement is ongoing, with a 4-week delay occurring as a result of unforeseen ground conditions and inclement weather.

· More broadly, the capital works programme for 2024/25 is progressing smoothly, and we remain on schedule to achieve our anticipated year-end position.

· In other significant Council decisions, the final proposal setting out Council's representation arrangements was adopted. A number of appeals/objections were received, and the matter has been set down for determination by the Local Government Commission following a hearing on 13 March 2025.

Council also considered a robust evidence-base to progress understanding of how various options might meet its strategic objectives and the legislative intent of the Local Water Done Well (LWDW) reform requirements

OPERATIONAL RISK AND STATUS TABLE

The operational risk table has been developed to show:

· Project or activity;

· Brief description of the risk and why it has arisen;

· Type of risk (e.g., timing, financial, service delivery);

· Project or topic status update;

· Items that the Committee needs to be aware of; and

· Traffic light system:

Green: Operational item, for information;

Orange: Potential to escalate, Council needs to be aware; and

Red: High risk, Council direction may be required.

|

20 March 2025 |

This is an up-to-date status and forward-looking report and may supersede the comments in the Scorecard Report. Additional information and topics may be provided at the meeting.

|

Topic and Description |

Risk Type and Risk Level |

|

Transportation Maintenance Activity A review of maintenance operational levels of service is underway, workshops are planned with Elected Members to consider operational new levels of service and performance frameworks. Construction of this year’s resurfacing programme is 80% complete (64km). Total 80km will be delivered. Investigation, design, and consenting of storm damage remedial works continues. Procurement is underway. Three pavement rehabilitation packages totalling 5.06km have been awarded and construction is underway at five rehab sites. Construction of a seal extension project is underway at Rotoheu Road. Design and construction are underway for the 81% emergency work subsidy. Investigation and design of next year’s (25/26) capital works programme is underway. |

Funding vs LOS |

|

No. 1 Road Pavement Rehabilitation and Seal Widening (RP300 – 1930) RP580 – 1960 (Stage 3) Construction is underway. Earthworks and stormwater drainage are well advanced. All stormwater discharge agreements have been finalised, and the stormwater discharge consent has been issued by BoPRC. Completion of pavement construction has been delayed by need to relocate buried utility services (telecom and water). Measures implemented to minimise delays for kiwifruit traffic. RP0 – 580 (Stage 2) Investigation and design are underway. Construction will be undertaken early during 2025/26. Procurement to be negotiated with current contractor to minimise delays. A speed Indicator Device (SiD) has been installed early 2025 to encourage drivers to abide by the 50kph speed limit. However, more engagement is needed with Police and packhouse to slow trucks down. |

Service Relocations Weather |

|

No. 4 Road Bridge Reinstatement Construction is underway. The bridge abutments are complete, and the bridge beam and deck sections have been installed. Project is delayed by four weeks due to abutment depth. However, this won’t impact Kiwifruit season. Riverbed scour is deeper than anticipated. Discussions with BoPRC underway. |

Weather |

|

SH2 Ōmokoroa Road Interim Intersection Upgrade Works Works completed to a level whereby we have a functional temporary roundabout, to allow traffic to be shifted. The temporary roundabout is in place as from 7 March, with a focus currently on the northern section of SH2. An alternative pavement design, using structural asphalt is utilised which accelerates construction (and enables savings on both cost and time) and minimises disruption to the public. The services work will begin on Ōmokoroa Road near the Industrial Road roundabout, and the crews will work their way forward towards Prole Road. Land Purchase The two land parcels required for the temporary roundabout construction have been acquired, with one more land requirement (400m2) required for construction of the roundabout at Francis Road. The agreement has been drafted and compensation agreed, additional costs regarding shifting of shelterbelts/ driveway being negotiated. No impact on construction programme. Stormwater Discharge The temporary stormwater pond for the Industrial Road has been completed, which handles stormwater for the project works from Prole Road to the Industrial Road. With this pond being completed, Council can complete the earthworks on Industrial and Ōmokoroa Roads. Overhead Power Supply Shifting of the overhead power lines on the SH was completed last year, which has allowed works to progress at the roundabout itself. There is similar requirement on Ōmokoroa Road, and we are awaiting the design to be approved by Powerco. The Powerco betterment (whereby 33kv cables are included in construction to futureproof power provision to Ōmokoroa), is tied in with this approval process, as well as the Industrial Road power requirements, to avoid separate processes and delays going forward. Fibre Optics The fibre optic works are progressing. There is a significant amount of work that needs to occur outside of the site along SH2 which HEB have been assisting with, by providing traffic management to expedite the works. Currently the cut over date for this in the programme is mid July, which will not impact our critical path in the construction programme currently. Project completion is now May 2026. This includes the Temporary RAB, industrial road and Omokoroa to The Railway. This is effectively a five month delay due to design and utility providers. |

Services, especially Network Utility (PowerCo), and their ability to resource and keep programme. Weather

|

|

Waihī Beach Stormwater Significant progress has been made on the maintenance programme and most activities has been completed. Staff have progressed a number of sites to developed design. Key projects and budgets have been included in the draft LTP and workshopped with Council. Now that the LTP is approved, the focus is moving to delivery. Project briefs have been developed and investigations are underway with significant projects, such as the upgrade of the Darley Drain Outlet and Brighton Reserve, and the removal of the Waihī Beach Dam and One Mile Creek stream improvements. Waihī Beach Wastewater Treatment Plant Staff continue to work through the detail for the repair and upgrade of the Waihī Beach Wastewater Treatment Plant. Steady progress has been made on the design, which includes re-establishment of a single cell HDPE lined SAS lagoon with improved aeration and refurbished decant facility. Detailed design is expected to be completed around March 2025. |

Further Site Deterioration Weather |

|

Katikati Wastewater Treatment Plant (WWTP) Outfall Pipeline Katikati Wastewater Advisory Group – Te Waiora to discuss the issues and available options. Land discharge options are currently being investigated for potential future discharge, however, following consultation with WWAG, Water Services will be in a better position to make recommendations on the most appropriate solution. The WWTP is struggling to meet compliance for nitrogen removal and needs to be upgraded. The upgrade works have been tendered as a design and build contract and awarded to APEX Water. Construction is progressing well with an estimated completion of the works in August 2025. Te Ohu Waiora has been established to develop a future directions report. Through this group, disposal solutions will be developed and recommended to Council. This will provide direction and inform a consenting process. |

Financial timing Regulation Enforcement Reputation |

|

Te Puke Wastewater Treatment Plant (WWTP) This project remains a concern and high risk. A specific PPG has been established to support this project with independent specialists relating to probity and technical. The contract with Councils design consultant has been terminated. Council has procured the services through an Early Contractor Involvement(ECI) process to assist the design and build. Alternative technology has been investigated through ECI contractor that appears to be a viable technical solution with significant cost savings. Council is currently seeking legal advice on converting the ECI contract to a Design and Build contract. A separate report will be presented to Council to discuss this further and seek approval to start physical works. Consent – The earthworks consent has been obtained. This allows earthworks to start once the design is complete. The discharge consent condition deadlines will not be met, and discussions are underway with the Regional Council to apply for a variation to the consent to adjust the deadlines. An application has been completed to request a change to the consent and the application will be discussed with iwi before submission. Consultation – Targeted consultation will be required for the final design. Iwi –Significant progress has been made with the relationship with iwi and how we can work together to enable a positive outcome for all involved. |

Compliance Reputation Finance Legal |

|

Rangiuru Business Park Quayside Properties Ltd continue to progress development of the Rangiuru Business Park. Quayside delivered contracts on behalf of Council which are well established and nearing completion. Staff continue in discussions with Quayside Properties Ltd regarding the Rangiuru Financial Contributions methodology and other requirements outlined in the district plan/plan change. The methodology for the financial contributions requires approval before 224 can be issued. |

On track |

|

Drinking Water Compliance The implementation of new legislation regarding drinking water has required Council to improve various components of the drinking water system, including its treatment. It should be noted that none of Councils supplies are compliant with the protozoa requirement. This will be resolved once UV installations are complete. The UV installations are budgeted for in future years and staff are considering options to fast track the implementation with the completion of the work around January 2026. Filters have been installed to reduce the turbidity at the Muttons Treatment Plant and that will enable the UV system to operate within compliance limits. Commissioning has been started but deteriorating water quality is hampering the successful operation of this plant. Fluoride update Athenree and Wharawhara WTP upgrade works (which includes fluoridation) design and build contract has been awarded to Apex Water. Completion of works is expected around November 2025; however, there have been some delay and indication that an extension to the deadline is required. The Ministry of Health have approved a new compliance date of 31 January 2026 for the Whararwhara and Athenree plants. |

Regulation enforcement Project Timing |

|

Heron Crescent Kitchens are in in Blocks A and B and will start on Block C this week. Project is progressing well and is currently ahead of schedule and is on budget at this point. The Team are currently looking at tenanting options through existing applications and new ones that are being received. |

On track |

|

Waihi Beach Library Positive progress is being made on the new Library. The project in on programme and under budget. Engagement is underway with the hall committee relating to the renovations. Concrete floor has been poured and materials ordered. |

On track |

|

Resource Consents of Interest · Te Puna Industrial Ltd- Notified Land use application (joint BOPRC and WBOPDC). Joint hearing to be heard by Independent Commissioners. This joint hearing commenced 9 July 2024 and was adjourned on 11 July 2024 to allow further information and clarification on the proposal to be provided by the Applicant. Timing for recommencement of the hearing unknown at this stage. · 24 Middlebrook Road, Katikati- Kainga Ora construction of 18 dwellings and subsequent freehold subdivision was granted on 21 August 2024. At this stage no application for building consent has been lodged. · Western Bay of Plenty District Council - 109 Clarke Road. This resource consent has been issued and we are progressing with the development of the sections for sale. · Glen Isla Protection Society Inc - a resource consent application for a 200m-long revetment wall (within the Three Mile Creek reserve and adjacent 9, 11, 13, 15, 16, 14 and 12 Glen Isla Place & above mean high water springs) for coastal erosion protection purposes has been received. A further information request has been sent to the Applicant. Once all information has been provided the (s95) notification decision will be made. · A second Waihi Beach seawall application (approximately 200m-long wall located between 17 - 41 Shaw Road) is expected to be lodged by the Waihi Beach Protection Society Inc, by the end of 2024. This proposal requires District and Regional Council consents given the location of the seawall below mean high water springs. · Bluehaven (Bell Road) - Application to be made under the Fastrack Approvals Bill (2024) when legislated. Land area of 335ha across two blocks targeting over 2000 homes, 80ha of employment land, using the fast-track approval process. The completed development may be 10 years away but looking at 2025-2026 to get through fast-track approvals. Key staff from BOPRC and WBOPDC are forming the working group to work with the developer and his team. Omokoroa Developments 1. 60 Prole Road (Blackridge/ Sabre) for 50 dwellings/lots (Stage 1). Comprehensive Consent (Land Use and Subdivision and urban design/typologies) to be lodged by early December 2024. 2. 149 Prole Road (Lighthouse Group) for 70+ dwellings/lots. Comprehensive Consent (Land Use and Subdivision and urban design/typologies). Application to be lodged late November 2024. 3. 62 Prole

Road (Neil Group) for 84 lots (2 Stages). Subdivision Consent (lots only, no

typologies presented) will be Te Puke Developments 4. Vercoe/Zest Development (Macloughlin Road) has resource consent approval for a 380 lot subdivision. The consent holders propose a variation to increase the yield up to 450 lots. Due Q1 of 2025. |

Public interest |

|

Regulatory Consenting – market and external impacts Meeting budget for the regulatory activity will continue to be a challenge for the 24/25 year as external factors continue to impact business. The building sector (in particular) is still being impacted by the current economic climate and this is represented in reduced volumes of applications against those projected for the building activity for the 24/25 year. Unbudgeted legal costs and building claims (historic claims through Leaky homes process, and related claims) continue to impact the regulatory budget delivery against projections. Management of staffing and contractor cost is being closely controlled within the activities, with savings being applied to those activities in line with a downturn. Resource Management and Building Control Act reforms are both projected in the future, but are not anticipated to impact the regulatory activity in this financial year. Building Services • There is an overall 15% decline in applications (a combination of new consents and amendments) for building services. As building services represents the highest revenue generating activity for regulatory this is having an impact on the overall regulatory financial position • Legal and settlement costs for Claims are also impacting this activity negatively. These additional costs are not included in BAU budgets, and funding to offset will be required, as it is not anticipated these costs will be able to be recovered across the overall regulatory service. Resource Consents and development Engineering • There is a positive increase in consent volumes for this activity- showing early signs of improvement in the economy and increased development activity. There is a noticeable “lag” in this positive sign being represented as an upturn in the building sector and consenting for new buildings. • These activities are showing positive revenue, and it is anticipated this trend will continue positively as signalled by the development community (update above).

|

Financial/Legislated/legal |

1. Quarterly

Scorecard Report Ending 31 December 2024 ⇩ ![]()

|

20 March 2025 |

10.2 2025/26 Procurement Strategy

File Number: A6655793

Author: Coral-Lee Ertel, Infrastructure Capital Delivery Manager

Authoriser: Cedric Crow, General Manager Infrastructure Services

Executive Summary

1. Project planning is underway for projects in the 2025/26 Annual Plan. Council is developing a procurement strategy to enable better procurement practices that aligns with the key procurement principles. A copy of the procurement strategy is included in Attachment 1. This report seeks Council's support for the Infrastructure Capital Projects Procurement Strategy to enable the procurement of projects for the 2025/26 Financial Year and in accordance with the Long Term Plan 2023/33.

|

1. That the Infrastructure Capital Delivery Manager’s report dated 20 March 2025 titled ‘2025/26 Procurement Strategy’ be received. 2. That the report relates to an issue that is considered to be of Low significance in terms of Council’s Significance and Engagement Policy. 3. That the Projects and Monitoring Committee supports the Infrastructure Capital Projects Procurement Strategy. 4. That the Projects and Monitoring Committee delegates the approval and signing of contracts included in the procurement strategy and funding provided for in the Long Term Plan to the Chief Executive Officer. 5. That the Projects and Monitoring Committee provides specific approval to the Chief Executive Officer to enable the Procurement and Contractual Commitments (per contract) for Goods/Services works that are budgeted within the Long Term Plan or Annual Plan greater than $1,000,000 included within Appendix A of the draft procurement strategy (Attachment 1). 6. That the Projects and Monitoring Committee approves the procurement of professional services required to enable the 2025/26 capital works programme in advance of the 2025/26 annual plan adoption. Noting, the projects are approved in the Long Term Plan. |

Background

2. A review of the 2025/26 capital works programme has been completed by staff and considers the following.

(a) Procurement required in the 2025/26 Financial year for the capital works programme.

(b) Capacity within the market for delivery of the capital works programme, including professional services and contractors

(c) Internal Council resources, capacity and capability.

(d) Planning requirements (including consenting, approvals and land purchases).

3. A draft procurement strategy has been developed in support of the 2025/26 Capital Works programme and is included in Attachment 1 of this report.

Key Aspects of the procurement Strategy

4. In October 2024 Council adopted its new procurement policy and is in development of a new Procurement Framework. The framework includes procurement principles that guide our procurement activities and ensures we achieve good outcomes. The new procurement framework includes a new procurement classification model that considers risk, complexity and value of the procurement. The Infrastructure Capital Projects Procurement Strategy adopts this approach to procurement and classification of all new procurement required for the 2025/26 FY has been completed. Projects with high complexity and risk with a total value of $1M or higher is considered comprehensive procurement and sit outside this strategy. These projects are;

(i) Te Puke WWTP upgrade

(ii) Katikati Wastewater Future Directions (Physical Works)

(iii) Waihi Beach Earth Dam (Physical Works)

5. Councils current draft Annual Plan includes a total of approximately $145M capital works related to the infrastructure group. The table below summaries the different procurement categories and general procurement approaches.

|

Procurement Categorisation |

Description and approach |

Value |

|

In Contract (Outside scope of strategy) |

Projects that have continued from previous financial years, and all procurement is in place. Multi-year projects. |

$61M |

|

Comprehensive Procurement (Outside scope of strategy) |

Complex procurement, that will require project specific procurement strategies or approval from Council or projects elected be excluded from this strategy for various reasons. |

$37M |

|

Simple or BAU procurement (Inside scope of strategy) |

Low value risk and complexity procurement. Typically procured through quotes, panels or invited tender. |

$20M |

|

Standard Procurement (Inside scope of strategy)

|

Med/High risk and complexity and generally higher in value. Physical works typically closed or open tender depending on projects risk. |

$27M |

6. A copy of the projects that meet the requirements of Standard, Simple or BAU procurement is included in Appendix A of the draft procurement strategy. It is the intent of the strategy that several projects will be bundled to enable better procurement.

7. The current procurement strategy requires a step change to become comprehensive. Planned enhancements include:

(a) Detailed market analysis: Though a high-level analysis has been done, more detailed trending and collaboration with neighbouring councils are needed. Specifically relating to local capacity and capability.

(b) Broader outcomes: These will be further developed for practical application in council procurement.

(c) Risk Register: Further work on the risk register aligning with Council risk and project risk.

(d) Bundling of projects: Look for opportunities to bundle projects, where appropriate for streamlined procurement. It Is noted that the bundling of projects may lead to a total contractual value of more than $1M and therefore specific approval is sought.

8. This work will be completed over the next few months before the new financial year in June. Meanwhile, we aim to procure professional services to start designing high-risk projects and avoid delays.

Approvals sought

9. This report seeks general support form the Projects and Monitoring Committee on the Infrastructure Services Capital Projects Procurement Strategy and its approach to procurement for the 2025/26 financial year.

10. Delegations currently require procurement over the value of $1M to be approved by Council. This report seeks that the approval and signing of contracts included within the procurement strategy, as detailed in the project list in Attachment A of the strategy, be delegated to the Chief Executive Officer subject to sufficient budget being available within the Long Term Plan or Annual Plan. It Is noted that several projects will be bundled for streamlined procurement purposes. The total value of the bundled works could exceed the $1M threshold, hence staff are seeking the approval of the full list of planned capital expenditure included within the scope of the strategy for completeness.

11. For the 2025/26 Annual Work programme to be delivered, Council will need to start engaging with professional services providers ahead of the Annual Plan adoption. This will allow sufficient time for planning and design. This report also seeks approval for Council staff to engage with professional services providers ahead of the 2025/26 Annual Plan adoption.

Significance and Engagement

12. The Local Government Act 2002 requires a formal assessment of the significance of matters and decision in this report against Council’s Significance and Engagement Policy. In making this formal assessment there is no intention to assess the importance of this item to individuals, groups, or agencies within the community and it is acknowledged that all reports have a high degree of importance to those affected by Council decisions.

13. The Policy requires Council and its communities to identify the degree of significance attached to particular issues, proposals, assets, decisions, and activities.

14. In terms of the Significance and Engagement Policy this decision is considered to be of Low significance because procurement set out in the strategy aligns with Councils procurement principles, Annual Plan and Long Term Plan.

Engagement, Consultation and Communication

|

Interested/Affected Parties |

Completed/Planned

|

||

|

Name of interested parties/groups |

Professional Services Providers, Contractors etc. |

Planned |

|

|

Tangata Whenua |

Will be considered within broader outcomes. |

||

|

General Public |

Consultation of projects through Long Term Plan. |

||

Issues and Options Assessment

|

Option A That Council supports the Infrastructure Capital Projects Procurement Strategy and That Council delegates the approval and signing of contracts included in the procurement strategy to the Chief Executive Officer and That Council approves the procurement of professional services required to enable the 2025/26 capital works programme in advance of the 2025/26 annual plan adoption. |

|

|

Assessment of advantages and disadvantages including impact on each of the four well-beings · Economic · Social · Cultural · Environmental |

Advantages: · Streamlines procurement · Enables more engagement with the market · Enables bundling of similar type work for enhanced procurement opportunities · Proactive planning for delivery of the 2025/26 Capital Works Programme. · Reduces risks to delivery of the 2025/26 Annual Plan Disadvantages: · Less Council control over procurement approaches |

|

Costs (including present and future costs, direct, indirect and contingent costs). |

N/A – Costs are as per the Annual Plan |

|

Other implications and any assumptions that relate to this option (Optional – if you want to include any information not covered above). |

N/A |

|

Option B That Council does not support the Infrastructure Capital Projects Procurement Strategy. |

|

|

Assessment of advantages and disadvantages including impact on each of the four well-beings · Economic · Social · Cultural · Environmental |

Advantages: · More Council control over procurement approaches Disadvantages: · Risk to delivery of the 2025/26 capital works programme · Ad-hoc procurement · More complex procurement approach |

|

Costs (including present and future costs, direct, indirect and contingent costs). |

N/A – Costs are as per the Annual Plan |

|

Other implications and any assumptions that relate to this option (Optional – if you want to include any information not covered above). |

N/A |

Statutory Compliance

15. The recommendation(s) in this report meets:

· Legislative requirements/legal requirements

· Current council plans/policies/bylaws

· Regional/national policies/plans.

Funding/Budget Implications

16. N/A as per draft Annual Plan.

1. Infrastructure

Capital Projects Procurement Strategy - Draft ⇩ ![]()

|

20 March 2025 |

10.3 Residual Town Centre Development Funds

File Number: A6657165

Author: Rebecca Gallagher, Acting Policy and Planning Manager

Authoriser: Rachael Davie, Deputy CEO/General Manager Strategy and Community

Executive Summary

1. Through the Long Term Plan 2024-34, Council resolved to permanently discontinue the collection of the Town Centre Development Fund and replace it with project specific funding identified through Council processes.

2. A decision on where the residual Town Centre Development Fund is allocated is required. The fund contains $402,000 of accumulated funds as at 30 June 2024.

|

1. That the Acting Policy and Planning Manager’s report dated 20 March 2025 titled ‘Residual Town Centre Development Funds’ be received. 2. That the report relates to an issue that is considered to be of low significance in terms of Council’s Significance and Engagement Policy. 3A. That the Projects and Monitoring Committee distribute the $402,000 held in the General Town Centre Development reserve equally between the following: · Katikati Town Centre Development reserve · Ōmokoroa Town Centre Development reserve · Waihī Beach Town Centre Development reserve · Te Puke Town Centre Development reserve. OR 3B. That the Projects and Monitoring Committee determine an alternative distribution arrangement being……

|

Background

3. The Town Centre Development Fund has been in place from 2007 to 2024, funded through a $10 per property rate as part of the Uniform Annual General Charge (UAGC). While the $10 per property rate has remained unchanged, the total amount collected has increased due to the rise in the number of rateable properties. Additionally, the Katikati Community Board area has an additional $22.40 per property targeted rate for Katikati Town Centre Development.

4. Through the Long Term Plan 2024-34, the Council resolved to permanently discontinue the collection of the Town Centre Fund. This will be replaced with project-specific funding, with projects to be identified through the Council’s established processes such as the Annual Plan and Long Term Plan.

5. The Town Centre Development Fund was originally established to provide a substantial capital fund for each of the major towns, supporting town centre development and upgrades. The fund was allocated on a rotating basis, with each town receiving the Town Centre Development Fund for a four-year period. The allocation order was determined based on the anticipated development needs and the status of each town’s town centre plans. The towns were allocated funding in the following order:

· Te Puke

· Waihī Beach

· Katikati

· Ōmokoroa

6. The Community Boards in these respective areas determined the works undertaken, with sign off by Council. The types of works undertaken have included:

· Te Puke (2007 – 2010) – A total of around $672,000 was used for the heritage walkway, Jubilee Park and associated town centre developments and the original main street upgrade. The town centre fund was a component.

· Waihī Beach (2011 – 2014) – A total of around $748,700 was used for town centre planning, Two Mile Creek walkway planning, Dillon Street land purchase and sale, future bridge over Two Mile Creek and future additional carpark.

· Katikati (2015 – 2018) – A total of around $720,000 used for upgrade of the ex-fire station to museum, Memorial Plaza in front of the Memorial Hall, Cherry Court upgrade, $200,000 contribution to Community hub, future implementation of the town centre plan.

· Ōmokoroa (2019 – 2022) – A total of around $880,000 used for purchase of the old library as a community building, old pavilion relocation and upgrade.

7. Decisions regarding the allocation of funds for the 2022/23 and 2023/24 periods have not yet been made, with these funds currently held in reserve pending further decision-making.

8. Not all accumulated funds have been fully spent. As of 30 June 2024, the following reserve balances for town centre development are recorded:

· Te Puke - $80,000

· Waihī Beach - $484,000

· Katikati - $620,000 (includes the additional funds from the Katikati Town Centre Development rate)

· Ōmokoroa - $118,000

· General town centre development reserve - $402,000

9. A reconciliation of all town centre development fund reserves is currently underway. Staff are working to identify specific projects to be funded through these reserves, and this will be brought back to the committee for further discussion at a later date.

10. A workshop held on 24 October 2024 focused on the unallocated town centre funds. During the session, it was agreed that potential options for the allocation of these funds would be presented to the Committee for consideration.

Significance and Engagement

11. The Local Government Act 2002 requires a formal assessment of the significance of matters and decision in this report against Council’s Significance and Engagement Policy. In making this formal assessment there is no intention to assess the importance of this item to individuals, groups, or agencies within the community and it is acknowledged that all reports have a high degree of importance to those affected by Council decisions.

12. The Policy requires Council and its communities to identify the degree of significance attached to particular issues, proposals, assets, decisions, and activities.

13. In terms of the Significance and Engagement Policy this decision is considered to be of low significance as it aligns with previous Council decisions. The decision on projects to be funded will be considered at a later date.

Engagement, Consultation and Communication

14. The decision on the specific projects that will be funded through the Town Centre Development funds rests with the Council, although it is typically made in consultation with the relevant Community Boards. Communication of the decisions facilitated by this report will be shared with the Te Puke, Waihī Beach, Ōmokoroa, and Katikati Community Boards.

15. Ongoing discussions with the relevant Community Boards regarding the proposed allocation and spending of the funds, as outlined above, are continuing.

Issues and Options Assessment

|

Option A That the Committee distribute the General Town Centre Development Reserve of $402,000 equally between Katikati, Waihī Beach, Ōmokoroa and Te Puke town centre development reserves. |

|

|

Assessment of advantages and disadvantages including impact on each of the four well-beings · Economic · Social · Cultural · Environmental |

- Promotes a sense of fairness and equal opportunity for development. - Easy to explain to the public that each town centre is receiving the same amount, helping to avoid any potential disputes or misunderstandings about allocation criteria. - Does not recognise the added benefit areas like Katikati and Ōmokoroa received from the increase in rateable properties. |

|

Option B That the Committee determine an alternative distribution arrangement being…..

|

|

|

Assessment of advantages and disadvantages including impact on each of the four well-beings · Economic · Social · Cultural · Environmental |

|

Statutory Compliance

16. The recommendations of this report meet the requirements of:

(a) the Local Government Act 2002, and

(b) The Local Government (Rating) Act 2002.

Funding/Budget Implications

|

Budget Funding Information |

Relevant Detail |

|

Town Centre Development Fund |

$402,000 and any interest accrued to be distributed in accordance with the decisions made through this report. |

1. Projects

and Monitoring Committee - Workshop Notes - 24 October 2024 ⇩ ![]()

|

20 March 2025 |

10.4 Proposal to name the Waihī Beach Library and Community Hub

File Number: A6654043

Author: Kerrie Little, Operations Manager

Authoriser: Cedric Crow, General Manager Infrastructure Services

Executive Summary

1. Naming of the new Waihī Beach Library and Community Hub

It was always the intention to approach our whanau at Te Whanau a Tauwhao to gift the Te Reo name for the new Waihī Beach Library and Community Hub.

They have gifted us –

Te Ara Mātauranga - The Pathway of Knowledge

Te Ara Mātauranga - The Pathway to Knowledge acknowledges the importance of Libraries as a place of learning. Te Ara translates to ‘The Path’, ‘The Way’ or ‘The Pathway’. Mātauranga translates as knowledge, wisdom, skills. A place that holds and provides worldly knowledge for all to thrive within. Tihei mauriora - we stand as living descendants of our ancestors.

|

1. That the Operations Manager’s report dated 20 March 2025 titled ‘Proposal to name the Waihī Beach Library and Community Hub’ be received. 2. That the report relates to an issue that is considered to be of low significance in terms of Council’s Significance and Engagement Policy. 3. That the Project and Monitoring Committee approves the Te Reo name of the new Waihī Beach Library and Community Hub to be Te Ara Mātauranga - Waihī Beach Library and Community Hub. 4. That the Project and Monitoring Committee does not approve the Te Reo name of the new Waihī Beach Library and Community Hub to be Te Ara Mātauranga - Waihī Beach Library and Community Hub. |

Background

Through community, Tangata Whenua and staff feedback, it became clear there is a need for a new facility within the Waihī Beach Community that provides connections to the digital world while also contributing to the wellbeing and social cohesion of our communities. This was first identified through the 2021-2031 Long Term Plan.

To ensure the Waihī Beach Community is provided with a facility that meets these needs the new space has been designed to be not only a library, but also a community hub, a council service centre and have opportunities for an integrated service delivery model. Engagement with Tangata Whenua have been a key part of this development.

Significance and Engagement

The Local Government Act 2002 requires a formal assessment of the significance of matters and decision in this report against Council’s Significance and Engagement Policy. In making this formal assessment there is no intention to assess the importance of this item to individuals, groups, or agencies within the community and it is acknowledged that all reports have a high degree of importance to those affected by Council decisions.

The Policy requires Council and its communities to identify the degree of significance attached to particular issues, proposals, assets, decisions, and activities.

In terms of the Significance and Engagement Policy this decision is considered to be of low significance because because the project has been consulted with Community, Tangata Whenua and Staff.

Engagement, Consultation and Communication

|

Interested/Affected Parties |

Completed/Planned

|

||

|

Name of interested parties/groups |

This name has been socialised with the Waihi Beach Community Board and they agree it is a suitable name. |

Planned |

Completed |

|

Tangata Whenua |

We have had several hui with Te Whānau ā Tauwhao and they are providing feedback and designs for the building. They have also gifted us this name and will provide names for internal spaces in the building. |

||

|

General Public |

Through the Community Board. |

||

Issues and Options Assessment

|

Option A THAT the Project and Monitoring Committee approve the Te Reo name of the new Waihi Beach Library and Community Hub to be Te Ara Mātauranga - Waihī Beach Library and Community Hub. |

|

|

Assessment of advantages and disadvantages including impact on each of the four well-beings · Economic · Social · Cultural · Environmental |

· Enables ‘branding’ for the project to be progressed. This builds goodwill towards the library · Gives a unique community identity to the building · Engagement with local Iwi will ensure the project tells a local story and is welcoming to all. |

|

Costs (including present and future costs, direct, indirect and contingent costs). |

N/A |

|

Option B THAT the Project and Monitoring Committee does not approve the Te Reo name of the new Waihi Beach Library and Community Hub to be Te Ara Matauranga - Waihī Beach Library and Community Hub. |

|

|

Assessment of advantages and disadvantages including impact on each of the four well-beings · Economic · Social · Cultural · Environmental |

· Negative relations with local Iwi. · Branding will not be consistent with other Service Centres |

|

Costs (including present and future costs, direct, indirect and contingent costs). |

N/A |

Statutory Compliance

While there is no specific policy to cover the naming of Council buildings this process meets all the criteria in Policy 8 – Naming in the Reserve Management Plan.

Funding/Budget Implications

|

Budget Funding Information |

Relevant Detail |

|

N/A |

|

|

20 March 2025 |

10.5 Development Trends Report 2024 Overview

File Number: A6660487

Author: Chloe Thyne, Research and Monitoring Analyst

Authoriser: Rachael Davie, Deputy CEO/General Manager Strategy and Community

Executive Summary

1. The purpose of this paper is to provide an overview of the SmartGrowth Development Trends Report 2024 which was completed and published in December 2024.

2. The report is produced annually by the SmartGrowth partners for the Western Bay of Plenty sub-region, covering the period 1 July 2023 - 30 June 2024. It contains subdivision, residential and non-residential development and population trends in Western Bay of Plenty District and Tauranga City.

3. The full SmartGrowth Development Trends Report 2024 report is attached along with a summary document setting out the key findings.

|

1. That the Research and Monitoring Analyst’s report dated 20 March 2025 titled ‘Development Trends Report 2024 Overview’ be received. 2. That the report relates to an issue that is considered to be of low significance in terms of Council’s Significance and Engagement Policy. 3. That the Projects and Monitoring Committee receives the Development Trends Report 2024 as set out in Attachment 1 and receives the Summary Report as set out in Attachment 2 of the agenda report. |

Background

4. New Dwellings consented (residential building) and New Lots created (subdivision activity) are the main measures of development.

5. Residential building and subdivision activity across the sub-region has slowed significantly in the last three years to historically low levels. The slowdown reflects broader economic pressures of high interest rates, inflation in building costs, shortage of developable land and decrease in demand.

6. This trend is being experienced in other growth regions around New Zealand and is consistent with past experience, driven by the cyclical nature of economic and property markets. As with previous recoveries, residential building and subdivision activity are expected to rebound in time.

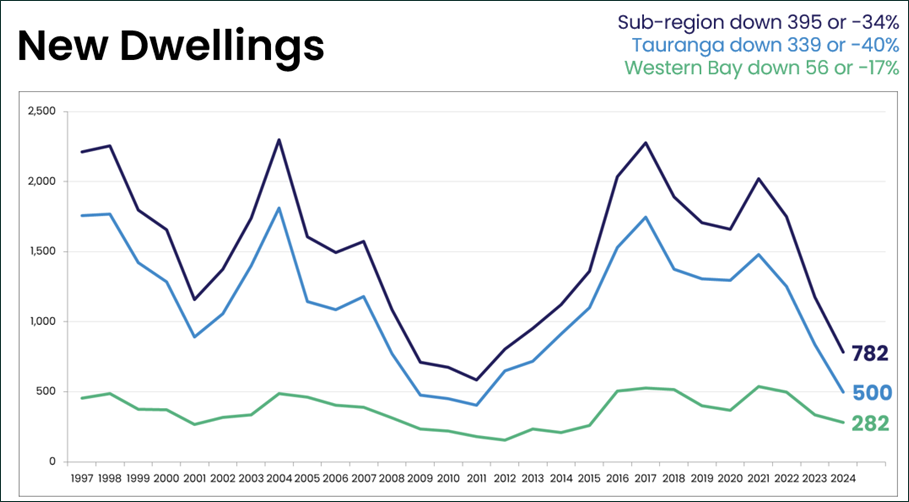

7. For 2023/24, Western Bay of Plenty District consented 282 new dwellings, down by 17% on the previous year. Tauranga City consented 500 new dwellings, down by 40%. A total of 782 new dwellings were consented in the sub-region, down by 34%.

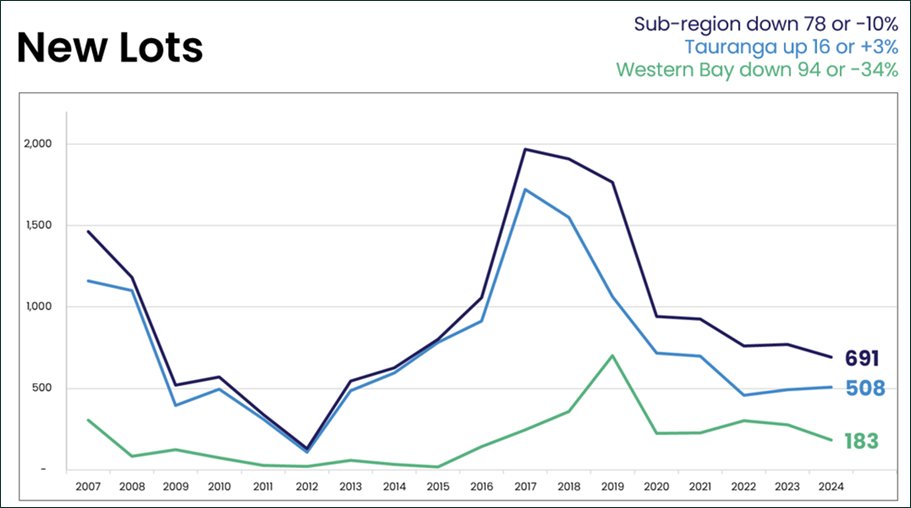

8. For 2023/24, 183 new lots were created in Western Bay of Plenty District, down by 34% on the previous year. Tauranga City saw a slight increase of 3% to 508 new lots. A total of 691 new lots were created in the sub-region, down by 10% overall.

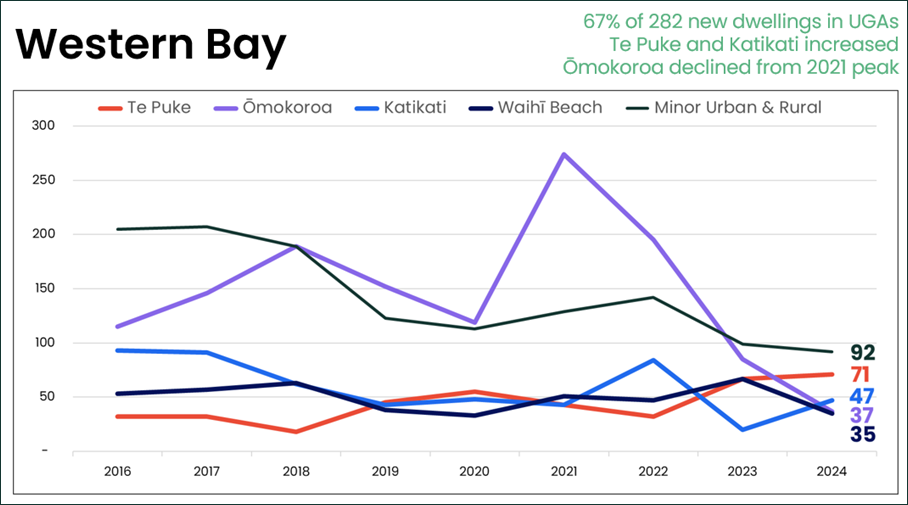

9. In Western Bay of Plenty District, urban growth areas attracted 67% of new dwellings consented in 2023/24, with 71 in Te Puke, 47 in Katikati, 37 in Ōmokoroa and 35 in Waihī Beach. Development in Ōmokoroa has diminished since the 2021 peak.

10. Dwellings consented in rural and minor urban areas were steady at 92 for the year.

11. The majority of dwellings consented were standalone at 65%, followed by duplexes at 18% and multi-unit dwellings at 13%. 74% were single storey dwellings.

12. Dwellings are getting smaller overall, down by 26m2 to 157m2 average floor size.

13. Construction cost increased by 13% to $3,648/m2. Construction cost has doubled in the last 7 years, being a major contributor to the residential building downturn.

14. Median selling price increased by 10% to $1,062,089. Average rent increased by 6% to $578 per week.

15. Regarding business land, Rangiuru has the most vacant industrial land in the sub-region at 265 ha, and Te Puke has 113 ha. Katikati, Te Puna, Ōmokoroa and Waihī Beach have smaller areas of vacant industrial land ranging from 25-40 ha each.

16. There were 9 Commercial buildings and 1 Industrial building consented for the year.

17. Refer to the full report in Attachment 1 for full details of development trends. A summary of key findings from the report has been produced to provide a snapshot of useful information for the Western Bay of Plenty District in Attachment 2.

Significance and Engagement

18. In terms of the Significance and Engagement Policy this decision is considered to be of low significance because there is no decision required beyond receiving the completed report and this is not considered to have any significant impact on residents of the District.

Engagement, Consultation and Communication

19. The Development Trends Report 2024 was published on Western Bay of Plenty District Council and Tauranga City Council websites on Friday 13 December 2024.

|

Interested/Affected Parties |

Completed/Planned Engagement/Consultation/Communication |

||

|

Name of interested parties/groups |

This is a monitoring report for information only, there is no requirement for community engagement or consultation. |

Planned |

Completed |

|

Tangata Whenua |

This is a monitoring report for information only, there is no requirement for community engagement or consultation. |

||

|

General Public |

This is a monitoring report for information only, there is no requirement for community engagement or consultation. |

||

Issues and Options Assessment

|

Insert summary resolution required |

|

|

Reasons why no options are available Section 79 (2) (c) and (3) Local Government Act 2002 |

Legislative or other reference |

|

There are no other practicable options for Council to consider aside from receiving the completed report, which provides statistics and trends. |

|

Statutory Compliance

20. The report satisfies obligations for Council to monitor Development Trends as part of the SmartGrowth partnership. It also plays a role in informing Council planning processes.

Funding/Budget Implications

21. The report has been produced within existing budgets and resources as part of the annual work programme.

1. SmartGrowth

Development Trends Report 2024 ⇩ ![]()

2. SmartGrowth

Development Trends Summary Report 2024 ⇩ ![]()