|

Audit and Risk Committee Komiti Taiwhenua

AR20-4 Thursday, 17 December 2020 Council Chambers Barkes Corner, Tauranga 1.00pm

|

|

Audit and Risk Committee Komiti Taiwhenua

AR20-4 Thursday, 17 December 2020 Council Chambers Barkes Corner, Tauranga 1.00pm

|

|

17 December 2020 |

Audit and Risk Committee

Membership

|

Chairperson |

Mayor Garry Webber |

|

Deputy Chairperson |

Cr James Denyer |

|

Members |

Cr Grant Dally Cr Mark Dean Cr Murray Grainger Cr Anne Henry Cr Christina Humphreys Cr Monique Lints Cr Kevin Marsh Cr Margaret Murray-Benge Cr John Scrimgeour Cr Don Thwaites |

|

Quorum |

6 |

|

Frequency |

Quarterly |

Role

To provide assurance and assistance to the Western Bay of Plenty District Council on management of Council's risk, financial control and compliance framework, and its external accountability responsibilities.

Scope

· Recommend to Council an appropriate risk management strategy and monitor the effectiveness of that strategy.

· Monitor the Council’s external and internal audit process and the resolution of any issues that are raised.

· Review key formal external accountability documents such as the Annual Report in order to provide advice and recommendation in respect to the integrity and appropriateness of the documents and the disclosures made.

· Provide a forum for communication between management, internal and external auditors and the governance level of Council.

· Ensure the independence and effectiveness of Council’s internal audit processes

· Oversee the development of the council’s Annual Report.

· Oversee the development of financial policies.

· Monitor existing corporate policies and recommend new corporate policies to prohibit unethical, questionable or illegal activities.

· Support measures to improve management performance and internal controls.

Responsibilities:

External Audit and External Accountability

· Engage with Council’s external auditors regarding the external audit work programme and agree the terms and arrangements of the external audit in relation to the Annual Report.

· To recommend the adoption of the Annual Report and the approval of the Summary Annual Report to Council.

· Review of the effectiveness of the annual audit.

· Monitor management response to audit reports and the extent to which external audit recommendations concerning internal accounting controls and other matters are implemented.

Internal Audit

· In conjunction with the Chief Executive and the Group Manager Finance and Technology Services, agree the scope of any annual internal audit work programme and assess whether resources available to Internal Audit are adequate to implement the programme.

· Monitor the delivery of any internal audit work programme.

· Assess whether any significant recommendations of any internal audit work programme have been properly implemented by management. Any reservations the Internal Auditor may have about control risk, accounting and disclosure practices should be discussed by the Committee.

Risk Management

· Review the risk management framework, and associated procedures to ensure they are current, comprehensive and appropriate for effective identification and management of Council’s financial and business risks, including fraud.

· Review the effect of Council’s risk management framework on its control environment and insurance arrangements.

· Review whether a sound and effective approach has been followed in establishing Council's business continuity planning arrangements.

· Review Council's fraud policy to determine that Council has appropriate processes and systems in place to capture and effectively investigate fraud-related information.

Other Matters

· Review the effectiveness of the control environment established by management including computerised information systems controls and security. This also includes a reviewing/monitoring role for relevant policies, processes and procedures.

· Review the effectiveness of the system for monitoring Council's financial compliance with relevant laws, regulations and associated government policies

· Engage with internal and external auditors on any specific one-off audit assignments.

· Consider financial matters referred to the committee by the Chief Executive, Council or other Council committees.

Power to Act:

The Committee is delegated the authority to:

· Receive and consider external and internal audit reports.

· Receive and consider staff reports on audit, internal control and risk management related matters.

· Make recommendations to the Council on financial, internal control and risk management policy and procedure matters as appropriate.

· To approve the Auditors’ engagement and arrangements letters in relationship to the Annual Report.

|

Audit and Risk Committee Meeting Agenda |

17 December 2020 |

Notice is hereby given that a Audit and Risk Committee

Meeting will be held in the Council

Chambers, Barkes Corner, Tauranga on:

Thursday, 17 December 2020 at 1.00pm

10.2 Summary of Audit and Risk Agenda Topics

10.4 Final Audit Management Report 2019-20

10.5 Review of Treasury Policy

10.6 Update on Outstanding Audit Items (Internal/External) November 2020

10.7 Quarterly Review of Risk Profile

10.9 Review of Governance in Context of Global Best Practice

12 Resolution to Exclude the Public

1 Present

Members are reminded of the need to be vigilant and to stand aside from decision making when a conflict arises between their role as an elected representative and any private or other external interest that they may have.

A period of up to 30 minutes is set aside for a public forum. Members of the public may attend to address the Board for up to five minutes on items that fall within the delegations of the Board provided the matters are not subject to legal proceedings, or to a process providing for the hearing of submissions. Speakers may be questioned through the Chairperson by members, but questions must be confined to obtaining information or clarification on matters raised by the speaker. The Chairperson has discretion in regard to time extensions.

Such presentations do not form part of the formal business of the meeting, a brief record will be kept of matters raised during any public forum section of the meeting with matters for action to be referred through the customer contact centre request system, while those requiring further investigation will be referred to the Chief Executive.

|

17 December 2020 |

File Number: A3934185

Author: Paige Marshall, Executive Assistant People and Customer

Authoriser: Jan Pedersen, Group Manager People And Customer Services

Executive Summary

1. Quarterly Health and Safety Report

This report provides a summary of:

· The health and safety performance across the organisation;

· Significant health and safety risks and safety events for the reporting period; and

· The progress against the health and safety strategy and work programme.

|

That the Group Manager People and Customer Services report dated 17 December 2020 titled ‘Health and Safety Report’ be received. |

Background

2. Health and Safety Performance

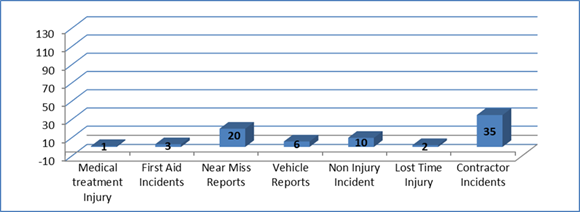

The graph and data below provide an overview of Council’s health and safety performance

Summary of Safety Events – 1 July 2020 – 30 November 2020

Year to Date – Significant Lost Time Injury/Medical Treatment Injuries - 1 July - 30 November

An aggressive customer entered the Barkes Corner customer service area on 1 July 2020 and threatened frontline staff. During this event, the customer threatened to shoot a member of the Animal Services Team who had impounded his dog. NZ Police were subsequently notified, charges were laid by the Police, and the customer was trespassed from Council service centres.

Affected staff were offered professional counselling and incident de-brief sessions. Further de-escalation/difficult customer training was subsequently held for frontline customer staff.

Other lost time injuries include a lower back strain and a contusion/bruising injury. Both staff members have successfully recovered from these injuries.

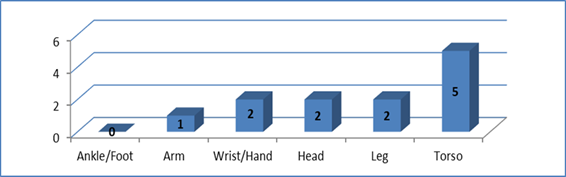

Types of Injuries Sustained, Year to Date – 1 July 2020 to 30 November 2020

Accident/Incident Frequency Rates

The metrics reported are:

· Lost Time Injury Frequency Rate (LTIFR). This is the average number of lost time injuries per 200,000 hours worked;

· Total Recordable Injury Frequency Rate (TRIFR). This is the average number of recorded injuries per 200,000 hours worked; and

· Number of Lost Time Injuries (LTI).

|

Metrics |

Council’s year to date records |

Local Government Industry Benchmark |

|

Average LTIFR (year to date) |

2 |

2.5 |

|

Average TRIFR (year to date) |

5 |

7 |

|

Average LTI’s recorded (year to date) |

2 |

3 |

Summary of Safety Events - Year to Date - 30 November 2020

|

Safety Events 1 July to 30 June |

Year to Date Results FY 2021 (Q1) |

Year to Date Results FY 2020 |

Year to Date Results FY 2019 |

|

|

Medical Treatment Injury |

1 |

5 |

1 |

|

|

First Aid Incidents |

3 |

8 |

23 |

|

|

Near Miss Reports |

20 |

49 |

33 |

|

|

Vehicle Reports |

6 |

11 |

38 |

|

|

Non Injury Incident |

10 |

15 |

51 |

|

|

Lost Time Injury |

2 |

3 |

4 |

|

|

Contractor Incidents |

35 |

150 |

123 |

|

|

Total Safety Event Reports |

77 |

241 |

273 |

|

|

Year to Date |

3. Health and Safety Hazard Risk Management

Council’s Health and Safety Risk register is currently under review with 80% of the hazards and risks now updated. The safety team will continue to monitor and review hazards and risks.

4. COVID-19 Management Planning

Council continues to monitor and respond to updates from central government’s communication and guidelines for COVID-19.

Council continues to communicate the key messages from central government including the need for good hygiene practices to all staff through posters, signage, COVID Tracker codes and the Health and Safety newsletter.

5. Health and Safety Strategic Work Programme

· Policy and guideline reviews;

· Safety site inspections and audits;

· Contractor management, including an online induction programme;

· Incident and accident safety management;

· Lone worker programme and GPS tracking;

· WorkWell – wellness accreditation programme; and

· Engagement and training with safety and wellbeing.

6. Safety Committee

Council has an active Health and Safety Committee, which includes representation from across the organisation. The Health and Safety Committee meet on a monthly basis and review safety events, policies and new legislation.

|

17 December 2020 |

10.2 Summary of Audit and Risk Agenda Topics

File Number: A3915697

Author: Kumaren Perumal, Group Manager Finance and Technology Services

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

The purpose of this report is to provide the Audit and Risk Committee (the Committee) with an overview of the content of the reports relating to risk, treasury, external and internal audit, insurance and other organisational matters covered in the meeting agenda.

Background

The purpose of the Committee work plan is to coordinate the delivery of the Committee’s role to provide assurance and assistance to Council on the management of Council’s risk, financial control and compliance framework and its external accountability responsibilities.

future ready organisation project

1. In response to a request made by the Committee at its May meeting to carry out a future readiness assessment for the organisation, Maven Consulting Group was appointed to help deliver this work. The project involved an assessment of how well positioned the organisation was to efficiently and effectively deliver local government services in the future.

2. Maven’s report, covered separately on this agenda, assesses Council’s current and future needs around people, processes and technology.

3. The report also provides recommendations on how the Council should invest to ensure it has the capabilities, resources and systems to address future needs. John Draper from the Maven Consulting Group will be in attendance at the meeting to present his report findings.

AUDIT new zealand – presentation of final audit management report 2019/20

Clarence Susan from Audit New Zealand will be in attendance to provide the findings outlined in the 2019/20 Final Audit Management report.

update on council’s insurance renewal process

Following a report presented at the August 2020 Committee meeting around the insurance renewal process staff have arranged for representatives from Aon (Council’s insurance broker) to attend the February 2021 Committee meeting to present the outcome of the 2020 insurance renewal process and impacts on Council’s insurance portfolio.

In addition to Council’s current insurance programme Aon will also cover a number of topics for Committee consideration and discussion ahead of the November 2021 insurance renewal process. In preparation for this discussion Aon have run a series of risk workshops with Council staff on 8 December covering a number of insurance risk management topics.

ADOPTION OF TREASURY POLICY

Bancorp Treasury (Council’s appointed treasury advisor) will be in attendance at the Committee meeting to present their review findings and recommendations arising from a recent review of Council’s Treasury Policy.

audit monitoring report (external/internal)

4. The Audit Monitoring Report provides a status update on management’s response to outstanding audit recommendations raised by Audit New Zealand as part of the external audit process and KPMG’s internal audit review of Council’s asset management planning processes and key financial controls.

QUARTERLY review of RISK PROFILE

5. At the May 2020 meeting, the Committee agreed the top ten risks to be retained as part of Councils risk profile and that ‘COVID-19’ and ‘Climate Change’ be incorporated into the existing list of risks for reporting where applicable. The Committee also agreed that ‘Fraud’ be included as an additional key organisational risk. The Risk Profile Report for the quarter ending December 2020 is included on this agenda.

treasury update

6. A report on the treasury related risks in the current economic climate and its impact on Council’s operating environment is provided separately.

INDEPENDENT REVIEW OF the EFFECTIVENESS OF the AUDIT AND RISK COMMITTEE

7. As part of the Committee Workplan for 2020, Graham Naylor from Naylor and Associates was appointed to undertake a review of the performance and effectiveness of the Committee. Mr Naylor will be in attendance at the Committee meeting to present his report findings and recommendations.

TAX GOVERNANCE FRAMEWORK

8. Work on Council’s tax governance framework is currently underway with PwC (Pricewaterhouse Coopers) and is intended to be presented to the Committee at its February meeting next year.

|

17 December 2020 |

10.3 Report on the Assessment of Western Bay of Plenty District Council as a Future Ready Organisation

File Number: A3929659

Author: Kumaren Perumal, Group Manager Finance and Technology Services

Authoriser: Miriam Taris, Chief Executive Officer

Executive Summary

1. This report seeks endorsement of the Report on the Assessment of Western Bay of Plenty District Council as a Future Ready Organisation (Attachment 1), that addresses how well positioned the organisation is to efficiently and effectively deliver local government services in the future and makes recommendations for change where needed.

|

1. That the Group Manager Finance and Technology Services report dated 17 December 2020 titled ‘Report on the Assessment of Western Bay of Plenty District Council As A Future Ready Organisation’ be received. 2. That the report relates to an issue that is considered to be of medium significance in terms of Council’s Significance and Engagement Policy. 3. That the Committee endorses the report and recommends the Chief Executive consider the Report on the Assessment of Western Bay of Plenty District Council and propose implementation budgets for consideration by the Annual Plan and Long Term Plan Committee in the development of the forthcoming draft Long Term Plan 2021-31. |

Background

2. Commissioning of Future Ready Organisation Report

In September 2020 following a competitive procurement process, Council appointed Maven Consulting group (“Maven”) to assess how well positioned the organisation was to efficiently and effectively deliver local government services in the future.

Maven’s assessment considered the Council’s current and future needs including people, process and technology and their report provides recommendations on how the Council should invest to ensure it has capabilities, resources and systems to address future needs.

This report follows a two month consultation process that involved more than forty Council managers and specialists as well as selected external partners and suppliers. The participants and external stakeholders included in this work are shown in Appendix 2 of the Future Ready Organisation report. Restructuring organisational functions was not a focus of this work.

In preparing their report, Maven considered the following:

· What will be required from local authorities in the future to be sufficiently agile and prepared to meet global and national risks and provide excellent public services;

· How that compares to the organisation’s current capacity, capability and direction, and;

· A range of scenarios and investment recommendations to effect change and take advantage of technology to meet future demands and opportunities.

The work undertaken by Maven is intended to inform decisions by Council’s elected members and senior management in order to:

· Place the organisation in a position to best use technology, people and processes to meet future challenges;

· Ensure the organisation delivers excellent service and is customer centric in its approach to delivery of its services, and;

· Equip the organisation with the tools and skills to be agile in response to global and national risk and change.

Significance and Engagement

3. The Local Government Act 2002 requires a formal assessment of the significance of matters and decisions in this report against Council’s Significance and Engagement Policy in order to guide decisions on approaches of engagement and degree of options analysis. In making this formal assessment it is acknowledged that all reports have a high degree of importance to those affected by Council decisions.

In terms of the Significance and Engagement Policy this decision is considered to be of medium significance. This is because the cost of implementation of the Maven recommendations is likely to be significant, with an impact on rates requirements. The significance is not rated as high because the decision being made by this Committee is to refer the decision on the proposed budgets to the appropriate (Annual Plan and Long Term Plan) Committee, rather than making a budget decision in this meeting.

Engagement on the LTP 2021-31 proposals will take place as part of the LTP consultation process in March/April 2021.

Engagement, Consultation and Communication

4. A number of internal and external stakeholders were engaged through workshops and interviews as part of this project.

|

Interested/Affected Parties |

Completed/Planned |

||

|

Council Staff |

Senior Management, staff including subject matter experts and third tier managers have contributed to this project through a series of interactive workshops and consultant interviews. A presentation on the deliverables was given by Maven on 23 November 2020. The final report will be available to all staff following Council’s endorsement. |

Planned |

Completed |

|

Tangata Whenua |

Tangata Whenua will be consulted as part of the projects implementation where appropriate. |

||

|

General Public |

The general public will have access to the report via Council’s website, as part of the meeting agenda. |

||

Issues and Options Assessment

5. The following Issues and Options have been assessed:

|

Option A The Committee endorses the report and recommends the Chief Executive consider the report on the Assessment of Western Bay of Plenty District Council as a Future Ready Organisation and propose implementation budgets for consideration by the Annual Plan and Long Term Plan Committee in the development of the forthcoming draft Long Term Plan 2021-31. |

|

|

Assessment of advantages and disadvantages including impact on each of the four well-beings · Economic · Social · Cultural · Environmental |

Advantage: Provides direction to CEO for organisational change to meet anticipated future needs of the District for public services and promotion of well-beings. |

|

Costs (including present and future costs, direct, indirect and contingent costs). |

N/A Costs of implementation will be considered by the Annual Plan and Long Term Plan Committee. |

|

Other implications and any assumptions that relate to this option (Optional – if you want to include any information not covered above). |

N/A

|

|

Option B Do not endorse the report

|

|

|

Assessment of advantages and disadvantages including impact on each of the four well-beings · Economic · Social · Cultural · Environmental |

Disadvantage: To the extent that the organisation is not able to respond to different and changing future needs of the District, future well-being may be negatively affected, for example by an organisation that is slow to respond, poorly equipped to deal with change and unable to take advantage of future opportunities. |

|

Costs (including present and future costs, direct, indirect and contingent costs). |

Costs of implementation can be avoided. This may have short-term benefits, but long term costs. |

|

Other implications and any assumptions that relate to this option (Optional – if you want to include any information not covered above). |

N/A

|

Statutory Compliance

6. There are no statutory compliance requirements relating to this topic. The scope and content of the Future Ready Organisation report is consistent with Council’s purpose, obligations and policies, particularly in relation to:

(a) Taking a long term view of organisational development, service planning and risk management;

(b) Being a good employer; and

(c) Ensuring Council has the capability and capacity to promote future well-being of the District.

Funding/Budget Implications

7. This Committee does not have the delegation to alter or approve budgets, but as a result of the recommended decision, the Annual Plan and Long Term Plan Committee would be requested to consider providing an implementation budget.

|

Budget Funding Information |

Relevant Detail |

|

|

The CEO will propose to include $10m (over 10 years) which includes a $1.5m provision for a new Enterprise Resource Planning (ERP) system in the draft 2021-2031 Long Term Plan to enable implementation of the recommendations in the Future Ready Organisation report. |

1. Future

Ready Organisation Report - An Assessment of Western Bay of Plenty District

Council as a Future Ready Organisation ⇩ ![]()

|

17 December 2020 |

10.4 Final Audit Management Report 2019-20

File Number: A3930854

Author: David Jensen, Senior Financial Planner

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. The purpose of the report is to provide Elected Members an opportunity to review the Audit Management Report on the audit of Western Bay District Council for the year ended 30 June 2020 (Attachment 1).

|

That the Senior Financial Planner’s report dated 17 December 2020 titled ‘Final Audit Management Report 2019-20’ be received. |

Background

2. This report follows the interim Management Report that was issued by Audit New Zealand on 21 April 2020 and presented at the Audit and Risk Committee meeting for information on 21 May 2020.

3. The final audit Management Report (the report) was issued on 13 October 2020 and has been reviewed by the Management Team. Management comments have been provided setting out proposed actions and areas for improvement in response to audit findings provided in the report.

4. Audit New Zealand issued an unmodified audit opinion on 24 September 2020. This means that Audit New Zealand was satisfied the financial statements and statement of service performance fairly reflected Council’s activity for the year and financial position at the end of the year.

5. Matters raised in Audit New Zealand’s audit plan, together with other findings and areas of focus, are noted in sections 3 (page 8) and section 4 (page 10) of the report.

6. Clarence Susan, the audit director, will be in attendance to present the report to the Committee.

1. Audit

Report to Council - 30 June 2020 ⇩ ![]()

|

17 December 2020 |

10.5 Review of Treasury Policy

File Number: A3919631

Author: David Jensen, Senior Financial Planner

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. Council is required to hold a Treasury Policy (Policy) incorporating Liability Management and Investment Policies under sections 104 and 105 of the Local Government Act 2002. Council engages its treasury advisor to review this policy during the preparation of each Long Term Plan to ensure compliance with legislation and with commercial best practice. This report seeks adoption of Western Bay of Plenty District Council’s revised Treasury Policy.

|

1. That the Senior Financial Planner’s report dated 17 December 2020 titled ‘Review of Treasury Policy’ be received. 2. That the report relates to an issue that is considered to be of low significance in terms of Council’s Significance and Engagement Policy. 3. That the Committee recommend to Council that the revised Treasury Policy be adopted. |

Background

2. The purpose of the Policy (Attachment 1) is to outline approved policies and procedures in respect of all treasury activity to be undertaken by Western Bay of Plenty District Council. The formalisation of such policies and procedures will enable treasury risks within Council to be prudently managed.

3. As circumstances change, the policies and procedures outlined in this Policy will be modified to ensure that treasury risks within Council continue to be well managed. In addition, regular reviews will be conducted to test the existing Policy against the following criteria:

- Industry “best practices” for a council the size and type of Western Bay of Plenty District Council;

- The risk bearing ability and tolerance levels of the underlying revenue and cost drivers;

- The effectiveness and efficiency of the Policy and treasury management function to recognise, measure, control, manage and report on Council’s financial exposure to market interest rate risks, funding risk, liquidity, investment risks, counterparty credit risks and other associated risks;

- The operation of a proactive treasury function in an environment of control and compliance;

- The robustness of the policy’s risk control limits and risk spreading mechanisms against normal and abnormal interest rate market movements and conditions; and

- Assistance to Council in achieving strategic objectives relating to ratepayers.

4. It is intended that the Policy be distributed to Council staff involved in all aspects of Council’s financial management process. In this respect, all staff must be completely familiar with their responsibilities under the policy at all times.

5. Council’s treasury advisors Bancorp Treasury Management will be in attendance to present the revised policy.

The key change to the updated Treasury Policy is noted below:

6. Interest Rate Control Limits

Council’s Debt Interest Rate Policy Parameter limits have been simplified and shortened to enable Council to take greater advantage of low floating interest rates. The proposed parameters are noted below:

|

Debt Interest Rate Policy Parameters (calculated on a rolling monthly basis) |

||

|

Period |

Minimum Fixed |

Maximum Fixed |

|

0 – 2 Years |

40% |

100% |

|

2 – 5 Years |

20% |

80% |

|

5 -10 Years |

0% |

60% |

Significance and Engagement

7. The Local Government Act 2002 requires a formal assessment of the significance of matters and decision in this report against Council’s Significance and Engagement Policy in order to guide decision on approaches of engagement and degree of options analysis. In making this formal assessment it is acknowledged that all reports have a high degree of importance to those affected by Council decisions.

8. In terms of the Significance and Engagement Policy this decision is considered to be of low significance because the policy enables the operational management of financial risk in relation to Council’s treasury activities.

Issues and Options Assessment

|

Recommend to Council the adoption of the revised Treasury Policy |

|

|

Reasons why no options are available Section 79 (2) (c) and (3) Local Government Act 2002 |

Legislative or other reference |

|

As noted in the Local Government Act 2002 (section 102 – Funding and Financial Policies) a Local Authority must, in order to provide predictability and certainty about sources and levels of funding, adopt funding and financial policies. |

- Sections 101, 101A, 102, 104, 105, 113 and Schedule 10 of the Local Government Act 2002 - Local Government (Financial Reporting and Prudence) Regulations 2014, Schedule 4. |

Statutory Compliance

9. The recommendation in this report enables Council to meet the requirements of the Local Government Act 2002 through the adoption of Liability Management and Investment policies.

Funding/Budget Implications

|

Budget Funding Information |

Relevant Detail |

|

Nil |

Adoption of the revised policy will provide Council with a guidance framework for conducting operational treasury functions, |

1. Western

Bay of Plenty District Council Treasury Policy - December 2020 ⇩ ![]()

|

17 December 2020 |

10.6 Update on Outstanding Audit Items (Internal/External) November 2020

File Number: A3915764

Author: Kumaren Perumal, Group Manager Finance and Technology Services

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. The purpose of this report is to provide status updates on management’s response to recommendations raised in management reports as part of the following processes:

(a) The audit of the Long Term Plan and Annual Report carried out by Council’s external auditor Audit New Zealand; and

(b) Internal audit reviews carried out by Council’s internal auditor KPMG as part of the internal audit work programme.

2. The status updates on external and internal audit recommendations have been amalgamated into one report (Attachment 1) with separate sections for external and internal audit items for ease of review.

|

That the Group Manager Finance and Technology Services report dated 17 December 2020 titled ‘Update on Outstanding Audit Items (Internal/External) November 2020’ be received. |

Background

Audit New Zealand

3. The Local Government Act 2002 requires Local Authorities to have their Annual Reports and Long-Term Plans audited by the Office of the Auditor-General. The Office of the Auditor-General has appointed Audit New Zealand as Council’s audit service provider.

4. The process for auditing the Annual Report and Long-Term Plan involves Audit New Zealand issuing an opinion that the information published in these documents fairly present the Council’s financial position and comply with legislation.

5. At the conclusion of each audit, Audit New Zealand provide a management report highlighting any issues they find, the degree of severity of the issue and a recommendation. Issues raised by Audit New Zealand are classed as “Urgent, Necessary or Beneficial“.

KPMG

6. During the 2016/17 financial year KPMG was appointed as Council’s internal auditor under a BOPLASS arrangement and worked with staff to establish a three-year internal audit plan. The audit plan was presented at the February 2020 Audit and Risk Committee. The audit plan outlines the intended areas of focus for 2017, 2018 and 2019 with confirmation sought from senior management on an annual basis.

7. The annual internal audit plan review for 2018 identified asset management and key financial controls as areas of internal audit focus. Status updates to the key findings are included in the attached audit monitoring table (Attachment 1).

1. Status

Update on Outstanding Audit Items (Internal/External) - November 2020 ⇩ ![]()

|

17 December 2020 |

10.7 Quarterly Review of Risk Profile

File Number: A3933102

Author: Guy Hobson, Risk Specialist

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. Following the review of risks at the last Audit & Risk Committee meeting, an updated Risk Profile document (Risk Profile) has now been completed (Attachment 1). The purpose of this report is to provide the Committee insight into the current status of the organisation’s eleven strategic risk areas.

Background

2. The risks included in the Risk Profile were reviewed at the last Audit and Risk Committee meeting on 13 August 2020. These have been reviewed and updated with additional information and commentary from staff around the organisation.

3. Risks updated this quarter include noting that the return of the Labour Party in the September election will mean that reform of Three Waters and the RMA are likely to accelerate. Impacts from COVID-19 have also been noted in the potential impact on our Kerbside Waste project; should the pandemic return there could be increased risk to the manufacture of new plastic bins, and as existing service providers withdraw from the market and reduce the size of their operations, this would be problematic if the project was delayed. COVID-19 impacts have been noted in the following strategic risk areas:

(a) General macroeconomic events (#4);

(b) Infrastructure (#6); and

(c) Growth and impact on infrastructure planning (#10).

These will be closely monitored, as they may take time to emerge.

4. Council continues to update its natural hazard maps for the District, including the consideration of sea level rise and heavier rainfall. Council now has updated flood modelling for the entire District and coastal inundation modelling for Waihi Beach, Tauranga Harbour and Pukehina, with remaining areas to be investigated within the next two years. We have coastal erosion lines for Waihi Beach, Tauranga Harbour and Pukehina, with remaining areas to be investigated over the next year. Tsunami modelling is available for Maketu, Pukehina and Little Waihi and the modelling for the rest of the District is expected in March/April 2021. Liquefaction is also being mapped for the District and is likely to be available at the same time. Council will also commence a review of stability / landslip hazards across the District next year. Council’s MAPI tool shows the most up-to-date information we hold about natural hazards and we will continue to get updates as new information becomes available.

5. Climate change risks can be found in the following strategic risk areas:

(a) Crisis management (#3);

(b) Macroeconomic impacts (#4);

(c) Infrastructure renewals (#6); and

(d) Growth and infrastructure planning (#10).

6. Following discussions with risk managers across Council there have been no further changes signalled to the risk ratings from the previous report.

Significance and Engagement

7. The Local Government Act 2002 requires a formal assessment of the significance of matters and decisions in this report against Council’s Significance and Engagement Policy in order to guide decisions on approaches of engagement and degree of options analysis. In making this formal assessment it is acknowledged that all reports have a high degree of importance to those affected by Council decisions.

In terms of the Significance and Engagement Policy this decision is considered to be of low significance because residents and ratepayers are not affected by the review. Ratepayers and residents would only be affected if a significant risk occurs. The top three residual risks for Council and the District being:

· A major natural disaster in the region;

· A major macroeconomic change impacting the national and regional economy; and

· Events impacting Council’s ability to maintain and renew infrastructure.

Engagement, Consultation and Communication

|

Interested/Affected Parties |

Planned |

||

|

Western Bay of Plenty District Council Management Team and Finance Team |

Appropriate staff to be notified accordingly. |

Planned |

|

|

Tangata Whenua |

Regular communication would be undertaken by Council in the event of a major risk eventuating. Civil Defence would deal with any emergency communications. |

||

|

General Public |

Regular communication would be undertaken by Council in the event of a major risk eventuating. Civil Defence would deal with any emergency communications. |

||

Issues and Options Assessment

|

That the Committee receive the Risk Specialists Report |

|

|

Reasons why no options are available Section 79 (2) (c) and (3) Local Government Act 2002 |

Legislative or other reference |

|

Council has agreed to regularly review its strategic risk as part of good governance and best practice. Emerging issues and changes in the operational environment necessitate a regular review of Council’s strategic risk. As a result it is likely that risks will be reprioritised and changed over time in response to environmental influences, legislative changes, government policy and the like. |

|

Statutory Compliance

8. The recommendation in this report complies with Council’s current Risk Management Policy. Risk assessment is integral to all of Council’s operations and forms a part of all Asset Management Plans.

Funding/Budget Implications

|

Budget Funding Information |

Relevant Detail |

|

Not currently applicable |

If changes to the risk priorities result in risk mitigation actions there may be budget implications |

1. 17

December 2020 Council Risk Profile ATTACHMENT A ⇩ ![]()

|

17 December 2020 |

File Number: A3935473

Author: David Jensen, Senior Financial Planner

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. This report provides an overview of the risks associated with Council’s treasury function and the procedures in place to mitigate those risks.

|

That the Senior Financial Planner’s report dated 17 December 2020 and titled ‘Treasury Update’ be received.

|

Background

2. This report gives an update on the treasury-related risks presented on 17 December 2020 in the wake of Covid-19 and its impact on Council’s operating environment.

Interest Rate Risk

3. Interest rate risk is the risk that either investment returns will fall materially short of forecast, or that financing costs will exceed projections due to adverse movements in interest rates.

4. The Reserve Bank held the Official Cash Rate (“OCR”) at 0.25% in its Monetary Policy Statement on 11 November 2020 and it is uncertain where the level will be set for the next update on 24 February 2021. While the Reserve Bank has indicated for a number of months that it is willing to cut the rate further, market developments (and particularly the housing market) have shown buoyancy.

5. Council’s interest rate hedging remains within policy, and we have a large degree of price certainty relating to our borrowing costs for the next 12 months due to our mixture of fixed and floating rate debt. While the longer term requires careful consideration, Council does not view short-term interest rate risk to be significant.

Liquidity and Funding Risk

6. Liquidity risk is the risk that Council may not have enough liquid cash or committed facilities on hand to fund operations. This is due to the fact that Council’s cash flow is dependent on the maturity of cash investments and loans.

7. Council ended the 2019/20 financial year in a strong cash position. Council has a debt maturity of $20 million due to the LGFA in May 2021 which, depending on market conditions and the decision of Council in relation to future expected expenditure, we could either repay or refinance. A paper will be presented to Council early next calendar year outlining the issues and options for both scenarios and seek Council‘s decision on the preferred approach.

Foreign Exchange Risk

8. Foreign exchange risk is the risk that volatile movements in foreign currency may adversely affect the cost to Council of entering into arrangements with offshore parties.

9. Council does not enter into significant foreign exchange contracts and this risk remains low.

Counterparty Credit Risk

10. Counterparty credit risk is the risk of losses occurring as a result of a counterparty default.

11. Council continues to require credit ratings of ‘A’ or higher when placing funds on deposit. This requirement may need to be revised depending on the current review of bank credit ratings by their respective rating agencies. Should market conditions continue to weaken, there is a strong likelihood that banks will receive a lower rating.

12. While there is a possibility that banks may receive a lower rating, they are not yet considered at risk of default. Council continues to view its counterparty risk as low.

|

17 December 2020 |

10.9 Review of Governance in Context of Global Best Practice

File Number: A3939423

Author: Kumaren Perumal, Group Manager Finance and Technology Services

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

When developing the 2020 work plan for the Audit and Risk Committee (the Committee) the Committee approved that an independent review be carried out to assess the Committee’s effectiveness against good practice. The purpose of this report is to advise the Committee that Mr Graham Naylor (Naylor and Associates) was appointed to undertake a review of the performance and effectiveness of the Audit and Risk Committee. Mr Naylor will be in attendance at the Committee meeting to present on his review findings and recommendations.

|

1. That the Group Manager Finance and Technology Services report dated 17 December 2020 titled ‘Review of Governance in Context of Global Best Practice’ be received. 2. That the Committee considers the recommendations from the review and advises which of the recommendations they would like to implement, and which they would like to see further developed for a later decision. |

|

17 December 2020 |

12 Resolution to Exclude the Public

|

That the public be excluded from the following parts of the proceedings of this meeting. The general subject matter of each matter to be considered while the public is excluded, the reason for passing this resolution in relation to each matter, and the specific grounds under section 48 of the Local Government Official Information and Meetings Act 1987 for the passing of this resolution are as follows:

|