|

Audit and Risk Committee Komiti Taiwhenua

AR20-3 Thursday, 13 August 2020 Council Chambers Barkes Corner, Tauranga 1.00pm

|

|

Audit and Risk Committee Komiti Taiwhenua

AR20-3 Thursday, 13 August 2020 Council Chambers Barkes Corner, Tauranga 1.00pm

|

|

13 August 2020 |

Audit and Risk Committee

Membership

|

Chairperson |

Mayor Garry Webber |

|

Deputy Chairperson |

Cr James Denyer |

|

Members |

Cr Grant Dally Cr Mark Dean Cr Murray Grainger Cr Anne Henry Cr Christina Humphreys Cr Monique Lints Cr Kevin Marsh Cr Margaret Murray-Benge Cr John Scrimgeour Cr Don Thwaites |

|

Quorum |

6 |

|

Frequency |

Quarterly |

Role

To provide assurance and assistance to the Western Bay of Plenty District Council on management of Council's risk, financial control and compliance framework, and its external accountability responsibilities.

Scope

· Recommend to Council an appropriate risk management strategy and monitor the effectiveness of that strategy.

· Monitor the Council’s external and internal audit process and the resolution of any issues that are raised.

· Review key formal external accountability documents such as the Annual Report in order to provide advice and recommendation in respect to the integrity and appropriateness of the documents and the disclosures made.

· Provide a forum for communication between management, internal and external auditors and the governance level of Council.

· Ensure the independence and effectiveness of Council’s internal audit processes

· Oversee the development of the council’s Annual Report.

· Oversee the development of financial policies.

· Monitor existing corporate policies and recommend new corporate policies to prohibit unethical, questionable or illegal activities.

· Support measures to improve management performance and internal controls.

Responsibilities:

External Audit and External Accountability

· Engage with Council’s external auditors regarding the external audit work programme and agree the terms and arrangements of the external audit in relation to the Annual Report.

· To recommend the adoption of the Annual Report and the approval of the Summary Annual Report to Council.

· Review of the effectiveness of the annual audit.

· Monitor management response to audit reports and the extent to which external audit recommendations concerning internal accounting controls and other matters are implemented.

Internal Audit

· In conjunction with the Chief Executive and the Group Manager Finance and Technology Services, agree the scope of any annual internal audit work programme and assess whether resources available to Internal Audit are adequate to implement the programme.

· Monitor the delivery of any internal audit work programme.

· Assess whether any significant recommendations of any internal audit work programme have been properly implemented by management. Any reservations the Internal Auditor may have about control risk, accounting and disclosure practices should be discussed by the Committee.

Risk Management

· Review the risk management framework, and associated procedures to ensure they are current, comprehensive and appropriate for effective identification and management of Council’s financial and business risks, including fraud.

· Review the effect of Council’s risk management framework on its control environment and insurance arrangements.

· Review whether a sound and effective approach has been followed in establishing Council's business continuity planning arrangements.

· Review Council's fraud policy to determine that Council has appropriate processes and systems in place to capture and effectively investigate fraud-related information.

Other Matters

· Review the effectiveness of the control environment established by management including computerised information systems controls and security. This also includes a reviewing/monitoring role for relevant policies, processes and procedures.

· Review the effectiveness of the system for monitoring Council's financial compliance with relevant laws, regulations and associated government policies

· Engage with internal and external auditors on any specific one-off audit assignments.

· Consider financial matters referred to the committee by the Chief Executive, Council or other Council committees.

Power to Act:

The Committee is delegated the authority to:

· Receive and consider external and internal audit reports.

· Receive and consider staff reports on audit, internal control and risk management related matters.

· Make recommendations to the Council on financial, internal control and risk management policy and procedure matters as appropriate.

· To approve the Auditors’ engagement and arrangements letters in relationship to the Annual Report.

|

Audit and Risk Committee Meeting Agenda |

13 August 2020 |

Notice is hereby given that a Audit and Risk Committee

Meeting will be held in the Council

Chambers, Barkes Corner, Tauranga on:

Thursday, 13 August 2020 at 1.00pm

9.1 Summary of Audit and Risk Agenda Topics

9.2 Quarterly Review of Risk Profile

9.4 Status Update on Outstanding Audit Items (Internal/External) August 2020

9.5 Review of Procurement Policy

9.6 Conflict of Interest, Sensitive Expenditure and Fraud Prevention and Corruption Policies

9.7 Overview of Council's Insurance Renewal Process.

9.8 Review of Accounting Policies, Key Accounting Estimates and Proposed Asset Revaluation Approach

9.9 Audit Discussion on COVID-19 Impacts

11 Resolution to Exclude the Public

1 Present

Members are reminded of the need to be vigilant and to stand aside from decision making when a conflict arises between their role as an elected representative and any private or other external interest that they may have.

A period of up to 30 minutes is set aside for a public forum. Members of the public may attend to address the Board for up to five minutes on items that fall within the delegations of the Board provided the matters are not subject to legal proceedings, or to a process providing for the hearing of submissions. Speakers may be questioned through the Chairperson by members, but questions must be confined to obtaining information or clarification on matters raised by the speaker. The Chairperson has discretion in regard to time extensions.

Such presentations do not form part of the formal business of the meeting, a brief record will be kept of matters raised during any public forum section of the meeting with matters for action to be referred through the customer contact centre request system, while those requiring further investigation will be referred to the Chief Executive.

|

13 August 2020 |

9.1 Summary of Audit and Risk Agenda Topics

File Number: A3801930

Author: Kumaren Perumal, Group Manager Finance and Technology Services

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. The purpose of this report is to provide the Audit and Risk Committee (the Committee) with an overview of the content of the reports relating to risk, treasury, external and internal audit matters and procurement covered in the meeting agenda.

|

1. That the Group Manager Finance and Technology Services’ report titled ‘Summary of Audit and Risk Agenda Topics’ be received. 2. That the Committee note the November meeting has been rescheduled to 17 December 2020. 3. That the Committee approve the updated Work Programme for 2020 (Attachment 1) |

Background

2. At its first meeting in February 2020, the Committee considered and approved a report setting out its work plan for 2020.

3. The purpose of the Committee work plan is to coordinate the delivery of the Committee’s role to provide assurance and assistance to Council on the management of Council’s risk, financial control and compliance framework and its external accountability responsibilities.

4. The work plan has been updated to reflect the rescheduling of specific agenda topics as per the table below and the incorporation of new agenda topics proposed for future meetings. A copy of the updated work plan is included as Attachment 1 to this report for the Committee’s approval.

|

Agenda Item |

Committee/Workshop Agenda |

|

Tax Governance Framework (PWC) |

Moved from August 2020 to December 2020 |

|

Approval of Draft Annual Report 2019/20 |

Moved to 1 September 2020 Audit & Risk Committee workshop |

|

Procurement Governance Framework/Policy update |

Moved from May 2020 to August 2020 – refer to separate report on this agenda. |

|

Future Ready Organisation |

New Agenda Item – December 2020 |

|

Audit and Risk Committee Work plan 2020 |

New Agenda Item – December 2020 |

QUARTERLY review of RISK PROFILE

5. At the May 2020 meeting, the Committee agreed the top ten risks to be retained as part of Councils risk profile and that ‘COVID19’ and ‘Climate Change’ be incorporated into the existing list of risks for reporting where applicable. The Committee also agreed that ‘Fraud’ be included as an additional key organisational risk.

TREASURY UPDATE

6. The Treasury update report provides an overview of Council’s key treasury risks and sets out the status of these risk levels in light of the current economic environment.

Status update on outstanding audit items (external/internal)

7. At the May 2020 Committee meeting, two separate reports were presented detailing management’s response to outstanding audit recommendations raised by Audit New Zealand as part of the external audit process and KPMG’s internal audit review of Council’s asset management planning processes and key financial controls.

8. These reports have now been combined into one report and one audit monitoring table which sets out the current status updates for both external and internal audit matters.

review of procurement policy

9. An annual review of the Procurement Policy and Procedures Manual has now been completed following consultation with staff and management. This report highlights key changes made to the Policy and Procedures Manual for Committee consideration.

Conflicts of Interest, Sensitive Expenditure and Fraud Prevention and Corruption Policies

10. A report covering Council’s approved Conflicts of Interest, Sensitive Expenditure and Fraud Prevention and Corruption Policies are included in the agenda for information.

overview of council’s insurance renewal process

11. A separate report summarising Councils’ annual insurance renewal process is included in the agenda. The report provides a high level overview of the type of insurance cover Council has in place and when the results of the renewal process will be reported to the Committee.

TAX GOVERNANCE FRAMEWORK

12. Work on Council’s tax governance framework is currently being prepared by PWC and will be presented at the December 2020 Committee meeting.

review of accounting policies, key accounting estimates and asset valuation approach

13. This report outlines the latest set of accounting policies that support the presentation of financial statements in the annual report and the approach for asset revaluations.

DRAFT ANNUAL REPORT 2019/20

14. The Draft 2019/20 Annual Report will be presented at an Audit and Risk Committee workshop scheduled for 1 September 2020 due to the timeline for the preparation of the document not coinciding with the Committee meeting schedule.

INDEPENDENT REVIEW OF the EFFECTIVENESS OF the AUDIT AND RISK COMMITTEE

15. As part of the Audit and Risk Committee Workplan for 2020, an independent expert will be appointed to undertake a review of the performance and effectiveness of the Audit and Risk Committee on an annual basis.

16. The results of this review will be presented at the December 2020 Committee meeting.

AUDIT DISCUSSION ON COVID-19 IMPACTS

17. Clarence Susan, Audit Director from Audit New Zealand, will be in attendance to provide an update on the impacts of COVID19 on the 2019/20 Annual Report.

1. Audit

and Risk Committee 2020 Workplan ⇩ ![]()

|

13 August 2020 |

9.2 Quarterly Review of Risk Profile

File Number: A3806001

Author: Guy Hobson, Risk Specialist

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. Following the review of risks at the last Audit & Risk Committee meeting, an updated Risk Profile document (Risk Profile) has now been completed (Attachment 1).

|

1. That the Risk Specialist’s Report dated 13th August 2020 and titled ‘Quarterly Review of Risk Profile’ be received. |

Background

2. The risks included in the Risk Profile were reviewed at the last Audit and Risk Committee meeting on 21 May 2020. The Committee requested that the existing top ten risks be retained and one further risk around fraud be added to the document. The impacts of COVID-19 and climate change have been added to existing risks within the Risk Profile. The risks around fraud have been based on the observations of Council’s internal auditor (KPMG) at other local authorities around New Zealand. KPMG were also quoted in recent press articles saying that they expected to see the current surge in fraud cases generally increase in the coming months.

3. Impacts from COVID-19 have been noted in the following strategic risk areas:

(a) general macroeconomic events (#4);

(b) infrastructure (#6); and

(c) growth and impact on infrastructure planning (#10).

These will be closely monitored, as they may take time to emerge.

4. Climate changes risks can be found in the following strategic risk areas:

(a) crisis management (#3);

(b) macroeconomic impacts (#4);

(c) infrastructure renewals (#6); and

(d) growth and infrastructure planning (#10).

5. Following discussions with risk managers across the business there have been no further changes signalled to the risk ratings from the previous report.

Significance and Engagement

6. The Local Government Act 2002 requires a formal assessment of the significance of matters and decision in this report against Council’s Significance and Engagement Policy in order to guide decision on approaches of engagement and degree of options analysis. In making this formal assessment it is acknowledged that all reports have a high degree of importance to those affected by Council decisions.

In terms of the Significance and Engagement Policy this decision is considered to be of low significance because residents and ratepayers are not affected by the review. Ratepayers and residents would only be affected if a significant risk occurs. The top three residual risks for Council and the District being:

· A major natural disaster in the region

· A major macroeconomic change impacting the national and regional economy

· Events impacting Council’s ability to maintain and renew infrastructure.

Engagement, Consultation and Communication

|

Interested/Affected Parties |

Planned |

||

|

Western Bay of Plenty District Council Management Team and Finance Team |

Appropriate staff to be notified accordingly. |

Planned |

|

|

Tangata Whenua |

Regular communication would be undertaken by Council in the event of a major risk eventuating. Civil Defence would deal with any emergency communications. |

||

|

General Public |

Regular communication would be undertaken by Council in the event of a major risk eventuating. Civil Defence would deal with any emergency communications. |

||

Issues and Options Assessment

|

That the Committee receive the Risk Specialists Report |

|

|

Reasons why no options are available Section 79 (2) (c) and (3) Local Government Act 2002 |

Legislative or other reference |

|

Council has agreed to regularly review its strategic risk as part of good governance and best practice. Emerging issues and changes in the operational environment necessitate a regular review of Council’s strategic risk. As a result it is likely that risks will be reprioritised and changed over time in response to environmental influences, legislative changes, government policy and the like. |

|

Statutory Compliance

7. The recommendation in this report complies with Council’s current Risk Management Policy. Risk assessment is integral to all of Council’s operations and forms a part of all Asset Management Plans.

Funding/Budget Implications

|

Budget Funding Information |

Relevant Detail |

|

Not currently applicable |

If changes to the risk priorities result in risk mitigation actions there may be budget implications |

1. Council

Risk Profile ⇩ ![]()

|

13 August 2020 |

File Number: A3805909

Author: David Jensen, Senior Financial Planner

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. This report provides an overview of the risks associated with Council’s treasury function and the procedures in place to mitigate those risks.

|

That the Senior Financial Planner’s report dated 22 July 2020 and titled ‘Treasury Update’ be received.

|

Background

2. This report gives an update on the treasury-related risks presented on the 13th August 2020 in the wake of Covid-19 and its impact on Council’s operating environment.

Interest Rate Risk

3. Interest rate risk is the risk that either investment returns will fall materially short of forecast, or that financing costs will exceed projections due to adverse movements in interest rates.

4. The Reserve Bank held the Official Cash Rate (“OCR”) at 0.25% in its Monetary Policy Statement on the 24th June 2020 and is widely expected to hold the OCR again at the next update on the 12th August 2020. The Bank’s quantitative easing programme of $60 billion has removed the volatility from the interest rate market and rates continue to track at record lows.

5. Council’s interest rate hedging remains within policy, and we have a large degree of price certainty relating to our borrowing costs for the next 12 months due to our mixture of fixed and floating rate debt. While the longer term requires careful consideration, Council does not view short-term interest rate risk to be significant.

Liquidity and Funding Risk

6. Liquidity risk is the risk that Council may not have enough liquid cash or committed facilities on hand to fund operations. This is due to the fact that Council’s cash flow is dependent on the maturity of cash investments and loans.

7. Council ended the 2019/20 financial year in a strong cash position. Council has a debt maturity of $20 million due to the LGFA in May 2021 which, depending on market conditions and the decision of Council in relation to future expected expenditure, we could either repay or refinance. A paper will be presented to Council early next calendar year outlining the issues and options for both scenarios and seek Council‘s decision on the preferred approach.

Foreign Exchange Risk

8. Foreign exchange risk is the risk that volatile movements in foreign currency may adversely affect the cost to Council of entering into arrangements with offshore parties.

9. Council does not enter into significant foreign exchange contracts and this risk remains low.

Counterparty Credit Risk

10. Counterparty credit risk is the risk of losses occurring as a result of a counterparty default.

11. Council continues to require credit ratings of ‘A’ or higher when placing funds on deposit. This requirement may need to be revised depending on the current review of bank credit ratings by their respective rating agencies. Should market conditions continue to weaken, there is a strong likelihood that banks will receive a lower rating.

12. While there is a possibility that banks may receive a lower rating, they are not yet considered at risk of default. Council continues to view its counterparty risk as low.

|

13 August 2020 |

9.4 Status Update on Outstanding Audit Items (Internal/External) August 2020

File Number: A3801929

Author: Kumaren Perumal, Group Manager Finance and Technology Services

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. The purpose of this report is to provide status updates on management’s response to recommendations raised in management reports as part of the following processes:

(a) The audit of the Long Term Plan and Annual Report carried out by Council’s external auditor Audit New Zealand; and

(b) Internal audit reviews carried out by Council’s internal auditor KPMG as part of the internal audit work programme.

2. The status updates on external and internal audit recommendations were reported as separate reports in previous Committee agendas. For the purposes of this report the status updates have been amalgamated into one report (Attachment 1) with separate sections for external and internal audit items for ease of review.

|

1. That the report titled ‘Status Update on Outstanding Audit Items (Internal/External) August 2020’ be received. 2. That the Committee note that internal and external audit items will now be reported in one report table for each Committee meeting. |

Background

Audit New Zealand

3. The Local Government Act 2002 requires Local Authorities to have their Annual Reports and Long-Term Plans audited by the Office of the Auditor-General. The Office of the Auditor-General has appointed Audit New Zealand as Council’s audit service provider.

4. The process of auditing the Annual Report and Long-Term Plan involves Audit New Zealand issuing an opinion that the information published in these documents fairly present the Council’s financial position and comply with legislation.

5. At the conclusion of each audit, Audit New Zealand provide a management report highlighting any issues they find, the degree of severity of the issue and a recommendation. Issues raised by Audit New Zealand are classed as “Urgent, Necessary or Beneficial“.

KPMG

6. During the 2016/17 financial year KPMG was appointed as Council’s internal auditor under a BOPLASS arrangement and worked with staff to establish a three-year internal audit plan. The audit plan was presented at the February 2020 Audit and Risk Committee. The audit plan outlines the intended areas of focus for 2017, 2018 and 2019 with confirmation sought from senior management on an annual basis.

7. The annual internal audit plan review for 2018 identified asset management and key financial controls as areas of internal audit focus. Status updates to the key findings are included in the attached audit monitoring table (Attachment 1).

1. Audit

Monitoring Report Status Updates ⇩ ![]()

|

13 August 2020 |

9.5 Review of Procurement Policy

File Number: A3806933

Author: Don Shewan, Contracts and Procurement Team Leader

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. Council’s Procurement Policy and Manual (the Policy) was presented to the Committee at its May 2020 meeting. The report set out how the procurement support function was delivered as part of Council’s business, the purpose and principles of the Policy and that the Policy was due for review as part of its annual review cycle.

2. The purpose of this report is to outline the key amendments made to the Policy as a result of the recently completed Policy review process.

3. Council‘s 2020 updated Policy is attached for Committee reference. (Attachment 1).

|

1. That the Procurement Team Leader’s report titled ‘Review of Procurement Policy’ be received. |

Background

4. The updated Policy prescribes how Council will procure goods and services. Originally approved in 2013, the Policy is reviewed annually to ensure it reflects the reality of Council‘s business, good practice and meets legislative requirements.

5. The updated Policy includes new policy content and amendments to existing content as follows:

(a) New policy content

(i) A description of the legislative framework

(ii) Disclosure of broader outcomes associated with local authority procurement from Ministry of Business Innovation and Employment and the Local Government Amendment Act 2002.

(b) Amended policy content

(i) Probity

(ii) Market approach

(iii) Financial thresholds

(iv) Insurance information and value thresholds

(v) Application of contract variation

6. The updated Policy has been approved by the Management Team.

1. Procurement

Policy Manual - August 2020 ⇩ ![]()

|

13 August 2020 |

9.6 Conflict of Interest, Sensitive Expenditure and Fraud Prevention and Corruption Policies

File Number: A3813034

Author: Kumaren Perumal, Group Manager Finance and Technology Services

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. Council has a number of sensitive policies which were updated as part of a cyclical review process in 2018 and 2019.

2. The Conflict of Interest, Sensitive Expenditure and Fraud Prevention and Corruption Policies are included in this report for reference.

|

1. That the report titled ‘Conflict of Interest, Sensitive Expenditure and Fraud Prevention and Corruption Policies’ be received. |

Background

3. Conflict of Interest Policy (Attachment 1)

As part of their 2019 interim audit, Audit New Zealand reviewed the Conflict of Interest Policy alongside the office of the Auditor-General’s good practice guide ‘Managing Conflicts of Interest: Guidance for Public Entities’. The policy was revised in response to audit recommendations to further improve the existing policy and include a new process for the investigation and determination of complaints relating to conflicts of interest and consequences for breach of policy by staff and Elected Members. The revised Policy was approved by Council on 18 April 2019.

4. Sensitive Expenditure Policy (Attachment 2)

Council’s revised Sensitive Expenditure Policy was endorsed by the Senior Management Team in July 2018 as part of the policy review cycle and approved by Council’s Policy Committee on 4 September 2018. It is due for review in September 2021 and attached for reference.

5. Fraud Prevention and Corruption Policy (Attachment 3)

The Fraud Prevention and Corruption Policy was reviewed and updated in response to recommendations from Audit New Zealand to further strengthen and incorporate key elements contained in the Ministry of Justice’s framework for creating a Fraud Prevention and Corruption Policy. An amended policy was reviewed and approved by the Senior Management Team in April 2019. The amended policy came into effect following Council‘s approval on 18 April 2019.

1. 2019

Conflicts of Interest Policy ⇩ ![]()

2. 2018

Sensitive Expenditure Policy ⇩ ![]()

3. 2019

Fraud and Corruption Prevention Policy ⇩ ![]()

|

13 August 2020 |

9.7 Overview of Council's Insurance Renewal Process

File Number: A3805865

Author: Kumaren Perumal, Group Manager Finance and Technology Services

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. Councils’ annual insurance renewal process is managed by insurance brokers AON NZ Ltd under the BOPLASS group of Councils.

2. Around July each year, AON begin the insurance renewal process for the year commencing 01 November which includes the following insurance policies:

· Aviation Hull insurance

· Commercial Motor Vehicles

· Infrastructure assets

· Material Damage/Business Interruption

· Forestry

· Travel

· Crime, Cyber

· Employers, Public, Professional Indemnity and Statutory Liability.

3. The renewal process for the submission of Council’s signed policy forms and asset details will be completed by the end of August 2020. AON will then arrange for the insurance policies for the BOPLASS group to be effective from the 1 November 2020 and will provide indicative premiums prior to this date. Actual premium invoices should be received during November 2020. An update will be provided at the next Audit and Risk Committee meeting to include any impacts on insurance premiums and any other insurance matters.

|

1. That the Committee receive the report titled ‘Overview of Council’s Insurance Renewal Process’. |

|

13 August 2020 |

9.8 Review of Accounting Policies, Key Accounting Estimates and Proposed Asset Revaluation Approach

File Number: A3812309

Author: David Jensen, Senior Financial Planner

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

The purpose of this report is to provide the Committee an opportunity to consider and comment on key discretionary elements of the 30 June 2020 Annual Report process, namely Council’s accounting policies, key accounting estimates and accounting treatment matters.

|

That the report by the Senior Financial Planner titled ‘Review of Accounting Policies, Key Accounting Estimates and Proposed Asset Revaluation Approach’ be received. |

Accounting Policies

1. Council is classified as a tier one public sector public benefit entity (PBE) under the multi-standards financial reporting framework introduced in New Zealand by the External Reporting Board effective 1 July 2014. The proposed accounting policies for the 30 June 2020 Annual Report are set out in Appendix 1.

2. There have been two changes in accounting policies proposed for this year as a result of International Public Sector Accounting Standard changes, these changes have been listed in the ‘Changes in Accounting Standards’ on the first page of Appendix 1.

3. There are also changes coming up over the next few years which have been listed in the ‘Standards issued and not yet effective, and not early adopted’ in Appendix 1.

Proposed Asset revaluation approach

4. Council undertakes a revaluation of all assets on a triennial basis, except for Council’s roading assets which are revalued each year.

5. Council is scheduled to revalue all assets for reporting in the Annual Report 2020-21 and work is underway collecting data to inform these valuations.

Key Accounting Estimates

6. At this stage there are no matters to draw to the Committee’s attention regarding key accounting estimates.

1. Proposed

Accounting Policies for the 30 June 2020 Annual Report ⇩ ![]()

|

13 August 2020 |

9.9 Audit Discussion on COVID-19 Impacts

File Number: A3812910

Author: Kumaren Perumal, Group Manager Finance and Technology Services

Authoriser: Kumaren Perumal, Group Manager Finance and Technology Services

Executive Summary

1. The COVID-19 pandemic crisis and its economic effects will have an impact on the preparation of the 2019-20 Annual Report and the subsequent audit of the Annual Report.

2. Clarence Susan from Audit New Zealand will attend the meeting to discuss the impact of COVID-19 for Council and the audit of our Annual Report, specifically:

(a) The impact of COVID-19 on preparers of financial statements

(b) Potential impact of COVID-19 on the audit opinion

(c) Areas that will need special consideration

(d) Impact of COVID-19 on non-financial reporting

(e) Guidance available

|

1. That the report titled ‘Audit Discussion on COVID-19 Impacts’ be received. |

|

13 August 2020 |

File Number: A3814239

Author: Paige Marshall, Executive Assistant People and Customer

Authoriser: Jan Pedersen, Group Manager People And Customer Services

Executive Summary

1. Health and Safety Information Report

This report provides Council with a brief summary of Council’s health and safety performance (year to date) and work programme for period ending 30 June 2020.

Background

2. Purpose – Quarterly Health and Safety Report

This report provides a summary of:

· The health and safety performance across the organisation

· Significant health and safety risks and safety events for the reporting period

· The progress against the health and safety strategy and work programme.

3. Health and Safety Performance

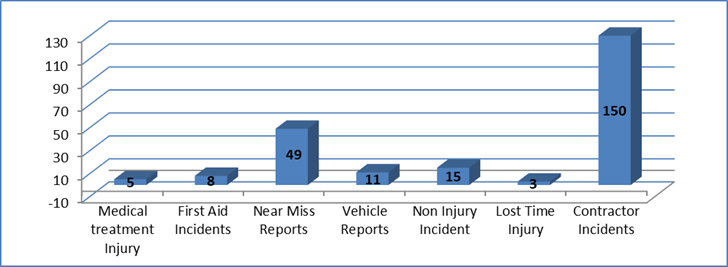

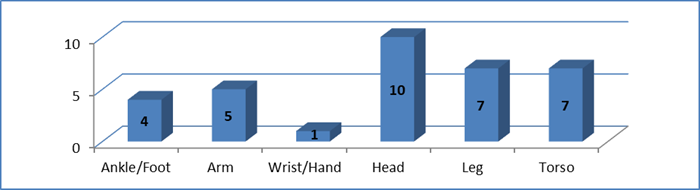

The graphs and data below provide an overview of Council’s health and safety performance.

Summary of Safety Events - 1 July 2019 – 30 June 2020

Year to Date – Significant Lost Time Injury/Medical Treatment Injuries

On 29 April 2020, a Compliance Officer was assaulted by a member of the public while investigating a complaint in rural Pukehina. The incident occurred during the COVID-19 level restrictions in which Council’s compliance officers were permitted undertake compliance site inspections under a strict safety plan. This incident relates to a physical assault by a member of the public who made physical assaults towards the staff member.

No injuries were suffered as a result of the assault; however the offender was charged by the Police and has subsequently pleaded guilty in Court. The Compliance Officer was well supported by another Council Officer who was also on site at the time.

Other lost time injuries include a lower back injury, ankle injury and strained leg muscle. These staff have now fully recovered from their injuries.

Types of Injuries Sustained, Year to Date – 1 July 2019 to 30 June 2020

Accident/Incident Frequency Rates

The metrics reported are:

· Lost Time Injury Frequency Rate (LTIFR). This is the average number of lost time injuries per 200,000 hours worked.

· Total Recordable Injury Frequency Rate (TRIFR). This is the average number of recorded injuries per 200,000 hours worked.

· Number of Lost Time Injuries (LTI).

|

Metrics |

Council’s year to date records |

Local Government Industry Benchmark |

|

Average LTIFR (year to date) |

2 |

2.5 |

|

Average TRIFR (year to date) |

8 |

7 |

|

Average LTI’s recorded (year to date) |

3 |

3 |

Summary of Safety Events - Year to Date - 30 June 2020

|

Safety Events 1 July to 30 June |

Year to Date Results FY 2020 (Q4) |

Year to Date Results FY 2019 |

Year to Date Results FY 2018 |

|

|

Medical Treatment Injury |

5 |

1 |

1 |

|

|

First Aid Incidents |

8 |

23 |

13 |

|

|

Near Miss Reports |

49 |

33 |

28 |

|

|

Vehicle Reports |

11 |

38 |

21 |

|

|

Non Injury Incident |

15 |

51 |

52 |

|

|

Lost Time Injury |

3 |

4 |

1 |

|

|

Contractor Incidents |

150 |

123 |

97 |

|

|

Total Safety Event Reports |

241 |

273 |

213 |

|

|

Year to Date |

Health and Safety Hazard Risk Management

Council’s Health and Safety Risk register has recently been reviewed. The safety team will continue to monitor and review hazards and risks.

COVID-19 Management Planning

Council continues to monitor and respond to updates from central government’s communication and guidelines for COVID-19.

As an organisation we continue to communicate the key messages from central government including the need for good hygiene practices to all staff through posters, signage, articles and the Health and Safety newsletter.

4. Health and Safety Strategic Work Programme

· Policy and guideline reviews

· Safety site inspections and audits

· Contractor management, including an online induction programme

· Incident and accident safety management

· Engagement and training with safety and wellbeing.

5. Safety Committee

Council has an active Health and Safety Committee, which includes representation from across the organisation. The Health and Safety Committee meet on a monthly basis and review safety events, policies and review new legislation.

|

13 August 2020 |

Please refer to Information Pack distributed separately.

|

13 August 2020 |

11 Resolution to Exclude the Public

|

That the public be excluded from the following parts of the proceedings of this meeting. The general subject matter of each matter to be considered while the public is excluded, the reason for passing this resolution in relation to each matter, and the specific grounds under section 48 of the Local Government Official Information and Meetings Act 1987 for the passing of this resolution are as follows:

|